In a current Economist article, Gita Gopinath thought of the implications of a AI bust comparable in magnitude to the 2001 dotcom bust for the worldwide financial system.

I assumed I might take into account a extra slim query of a what occurs to US family wealth. Take into account family fairness and mutual fund wealth as a element of internet price.

Determine 1: Family internet price ex-equity+mutual funds (teal bar), family holdings of fairness+mutual funds, mn. 2017$. Deflated by PCE deflator. NBER outlined peak-to-trough recession dates shaded grey. Supply: Federal Reserve Circulate of Funds, and BEA through FRED, NBER, creator’s calculations.

Mid-2025 family wealth in equities and mutual funds is roughly $51 trillion. A 26% drop in capitalization — as happened 2000Q4-2001Q4 — would cut back that by $13.3 trillion (all ballpark figures). (Gopinath’s calculation was possible primarily based on whole capitalization, together with shares held by rest-of-the-world).

If the sensitivity of consumption to wealth is 5 cents on the greenback, then that interprets to a discount of some Ch.17$ 526 billion, or about 3% of mid-2025 consumption, distributed over a number of years. Utilizing a sensitivity of three cents on the greenback (is likely to be extra acceptable for fairness wealth), then a discount of about 1.9% is implied.

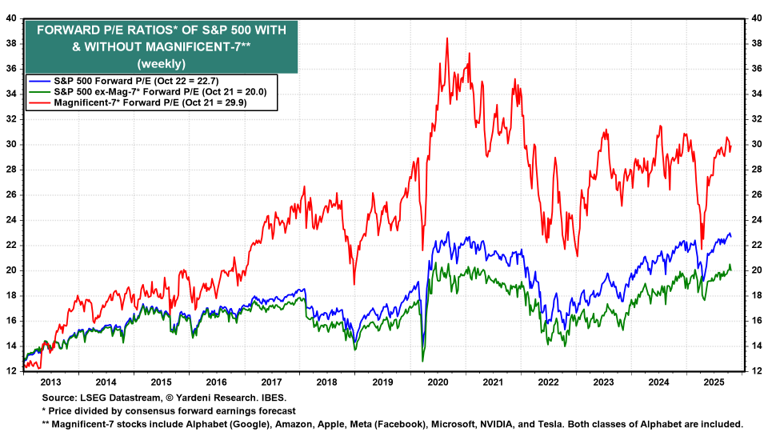

For reference, listed here are the ahead P/E ratios for the Magnificent 7 and the S&P500, together with and excluding the Magnificent 7:

Supply: Yardeni.com.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be part of our rising group at nextbusiness24.com