This week’s livestream that includes Menzie Chinn and Lydia Cox, moderated by Mike Knetter, is Tuesday, Aug. 5, at 7 p.m. CDT (hosted by the Wisconsin Alumni Affiliation):

Register right here.

Within the first half of the yr, the Trump administration has reshaped many elements of financial coverage, usually in methods which can be at odds with the views of out of doors economists. As Trump’s financial agenda takes form, many are questioning about its impression. How are tariffs affecting costs for shoppers? Are the largest impacts behind us or but to come back? How will the brand new federal funds have an effect on the deficit? Will the administration exert extra strain on the Federal Reserve and its chair? And what does this all imply for the common American?

My pictorial evaluation:

Determine 1: Nonfarm Payroll from CES (daring blue), implied NFP Bloomberg consensus as of seven/1 (blue +), civilian employment with smoothed inhabitants controls (orange), industrial manufacturing (purple), private earnings excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2025Q2 advance launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/1/2025 launch), and writer’s calculations.

The labor market actually does seem like it’s slowing down…

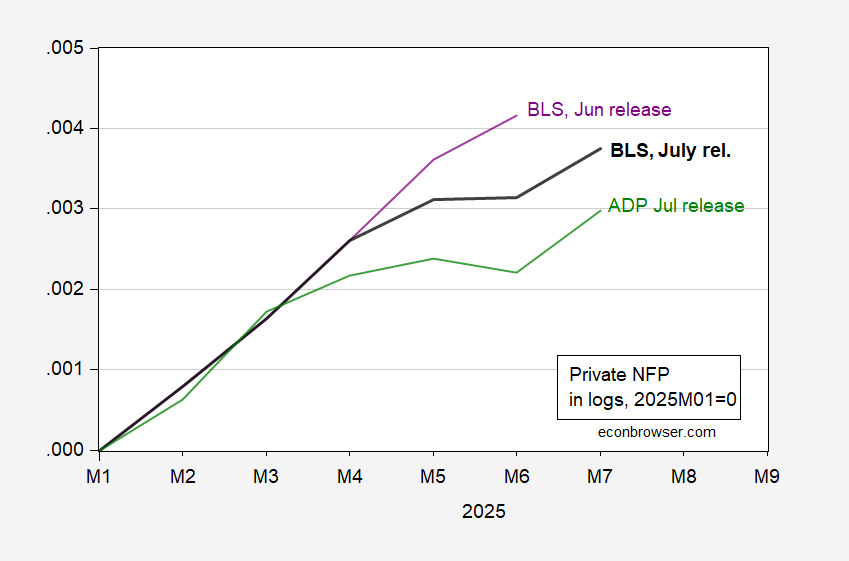

Determine 2: Personal nonfarm payroll employment, July launch (daring black), Jun launch (purple), ADP July launch (inexperienced), all s.a., in logs, 2025M01=0. Supply: BLS, ADP through FRED, and writer’s calculations.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be part of our rising neighborhood at nextbusiness24.com