The frontline index Nifty 50 touched 26,000 ranges on October 23 after almost 13 months when it final closed at document highs (September 27, 2024). As markets chartered a risky path over the previous yr or so, fairness mutual funds from the highest 5 classes have given a fairly wholesome account of themselves in beating their respective benchmark indices on absolute in addition to SIP returns foundation.

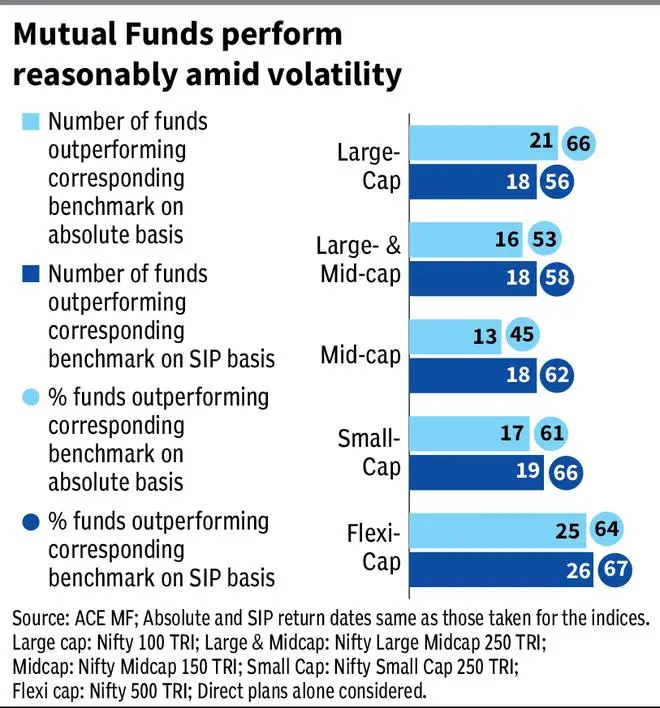

Take into account this. The highest 5 classes, with over ₹20 lakh crore in complete corpus and which account for 60 per cent of the lively fairness mutual funds AUM (property beneath administration) have 158 schemes presently operational. Of those, roughly 92 schemes have performed higher than their benchmark on an absolute foundation over the previous 13 months and 99 funds have outperformed the corresponding indices on an SIP foundation over this era.

That’s roughly six in 10 funds outperformed in every case. As home buyers pour over ₹29,000 crore each month, it’s clear that they see their funds had coped properly within the gyrating markets of the previous yr.

Gauging indices

We’ve taken the Nifty 100 TRI because the benchmark for large-cap, Nifty Massive Midcap 250 TRI for large- and mid-cap, Nifty Midcap 150 TRI for mid-cap, Nifty Smallcap 250 TRI for small-cap and Nifty 500 TRI for flexi-cap funds. Solely the direct plans of funds are thought-about.

Absolute returns for the indices and funds are taken from September 27, 2024 to October 23, 2025. SIP returns (XIRR: prolonged inside charge of return) are taken for 13 instalments (September 27, 2024 to September 27, 2025), with the valuation date as October 23, 2025.

Now, all of the indices recorded destructive returns on an absolute foundation. In distinction, on an SIP foundation, the XIRR is optimistic for all indices over the 13-month interval.

Scoring on SIPs

Massive-cap funds delivered the very best efficiency on an absolute returns foundation among the many 5 classes. Round 66 per cent, or two-thirds, of the funds within the class beat the Nifty 100 TRI over the September 2024-October 2025 interval. Curiously, the class noticed fewer funds outperform on an SIP foundation, maybe as a result of large-caps corrected much less in the course of the yr, providing fewer alternatives for SIPs to capitalise on volatility.

Flexi-cap funds scored properly on each absolute and SIP returns foundation. Round 64 per cent funds from the class outperformed absolutely the returns of the Nifty 500 TRI, whereas 67 per cent did higher than the benchmark on an SIP foundation.

For a class that’s thought-about most dangerous, small-cap funds managed to ship sturdy performances with 61 per cent of the schemes beating the Nifty Smallcap 250 TRI and 66 per cent getting previous the benchmark on an SIP foundation.

Massive- and mid-cap funds put out middling performances with barely over half the funds beating the benchmark index on an absolute and XIRR foundation.

Mid-cap funds delivered a efficiency that was underwhelming in comparison with different classes as solely 45 per cent funds bettered the Nifty Midcap 150 TRI on absolute returns. However buyers taking the SIP route would have been higher rewarded with 62 per cent funds outperforming the benchmark.

A few pointers turn into clear right here from an investor’s perspective although this evaluation covers solely the efficiency within the latest previous.

Persevering with SIPs throughout risky and falling markets is essential to common prices and generate higher returns, extra so for the long run.

For riskier classes reminiscent of mid- and small-caps, taking the SIP route provides a greater likelihood at beating the benchmark.

Whereas this reinforces the significance of constant SIPs throughout risky markets, it’s value noting that these observations are drawn from a comparatively quick 13-month window. This short-term sample merely echoes the longer-term advantages seen throughout earlier market cycles.

Revealed on October 25, 2025

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our publication, and be a part of our rising group at nextbusiness24.com