We had given an ‘accumulate’ name on the inventory of State Financial institution of India (SBI), nearly the identical time final 12 months. Since then, SBI has delivered a wholesome FY25 with a file revenue of ₹71,000-odd crore and best-ever asset high quality, a minimum of within the final 25 years. Deposits and advances crossed respective milestones of ₹50 lakh crore and ₹40 lakh crore. With that scale, SBI makes greater than one-fifth of the business banking system. Its latest efficiency reminds one of a big Japanese 4×4 car that’s well-engineered for heavy obligation – constant, dependable and predictable.

Such efficiency continued within the financial institution’s Q1 FY26 outcomes as effectively. Throughout the quarter, three facets have been speaking factors within the banking business – progress, asset high quality and margins. SBI has fared and can also be set to fare effectively on all three counts – according to the business, if not higher.

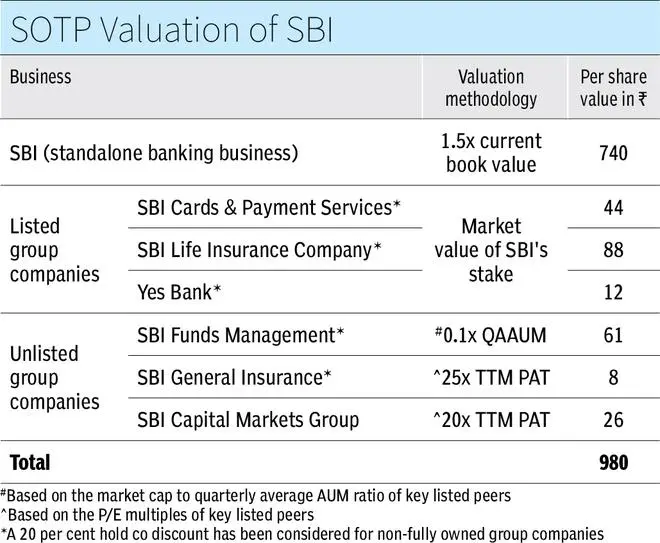

Ever since our final name, the inventory briefly rallied to ₹875 however has largely remained below our beneficial value of ₹816 – giving ample shopping for alternatives when it dipped to ₹700-odd ranges. We now improve the decision to a ‘purchase’, with a revised SOTP (sum-of-the-parts) goal value of ₹980 (from about ₹900 earlier), the place there’s a 22 per cent upside.

Nonetheless, sure draw back dangers do stay within the type of a doable slowdown within the economic system, triggering a recent NPA cycle – particularly among the many susceptible SMEs and execution dangers to a guided margin of three per cent. Therefore, long-term buyers prepared to look previous these dangers can guess on the banking behemoth.

Stability sheet progress

With a slowing economic system, credit score progress within the system has slowed as effectively — from the mid-teen to twenty per cent progress (12 months on 12 months) in FY23-24 to 9.5 per cent in Q1 FY26. SBI managed to put up 11.6 per cent progress in each advances and deposits, regardless of its steadiness sheet measurement. Inside deposits, CASA grew 8 per cent and time period deposits at a faster 14 per cent (each home). On the advances entrance, retail (36 per cent share) grew 13 per cent, agri (8 per cent share) 13 per cent and SME (12 per cent share) 19 per cent. Nonetheless, the company guide (28 per cent share) was a laggard, rising at simply 6 per cent – slower than the tempo of progress of the general guide, much like FY25.

The administration attributes this to the falling rate of interest atmosphere. With charges getting decrease, corporates want to refinance at cheaper and unfavourable charges for the financial institution. So, the financial institution needed to let go of some accounts and settle for prepayment. Corporates even have most well-liked decrease yields within the cash market to financial institution credit score. This explains the slowdown. Nonetheless, SBI has a big sanction pipeline of ₹7.2 lakh crore but to be disbursed. This could add to the guide’s progress.

Just like the company guide, inside retail, private loans (8 per cent share) and auto loans (3 per cent share) have seen decrease traction. Although the slowdown in auto loans could be attributed to the sluggish auto market, the financial institution feels it might’ve executed effectively with private loans (largely given to salaried public servants). Demand throughout the festive season ought to help an uptick in these segments.

A powerful steadiness sheet

To this point, as of Q1, banks with completely no issues on asset high quality are few and much between, and SBI is one in all them. Headline asset-quality ratios remained regular – the GNPA and NNPA ratios at 1.8 and 0.5 per cent respectively. Slippage ratio (that measures new additions to NPAs as a share of advances) inched up 20 bps although, on a quarter-on-quarter foundation, largely as a result of Q1 is seasonally a weak quarter. The ratio at 0.75 per cent is 9 bps decrease than that of Q1 FY25. The administration expects the ratio to be beneath 0.6 per cent for FY26.

SBI’s SME loans are both secured or backed by the CGTMSE (Credit score Assure Fund Belief for Micro and Small Enterprises) assure. GNPA ratio rose 14 bps to 1.21 per cent within the private loans. Nonetheless, that is as a result of anaemic progress within the mortgage base (year-on-year progress of 0.5 per cent in FY25 and 0.34 per cent in Q1 FY26).

Additional, the financial institution holds non-NPA provision buffers of ₹30,345 crore, amounting to 0.7 per cent of gross advances. The financial institution’s CRAR additionally was boosted by the latest ₹25,000-crore QIP, taking it as much as 15.9 per cent. General, the steadiness sheet seems sturdy.

Margin outlook

With 100 bps of repo cuts in place, SBI’s home NIM (home loans are 85 per cent of the mortgage guide) contracted 13 bps to three.02 per cent. Although there could possibly be additional contraction in Q2, the administration has guided for NIM (home) to be maintained at 3 per cent for FY26, as a big a part of the time period deposit guide is about to reprice in Q3 and This fall. The CRR minimize and its beneficial impression on value of funds, can also help margin. RoA has been guided at 1 per cent.

How subsidiaries fared

The financial institution’s group entities proceed to put up respectable efficiency. These account for twenty-four per cent of our SOTP value. Notably, the life insurance coverage and mutual fund arms posted wholesome revenue progress of 14 per cent and 24 per cent respectively, in Q1 FY26. Normal insurance coverage enterprise delivered a flat revenue progress, whereas SBI Playing cards’ revenue declined 6.4 per cent because it continues to grapple with weak asset high quality. SBI Playing cards’ CRAR is enough at 23.2 per cent.

Revealed on August 9, 2025

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be a part of our rising neighborhood at nextbusiness24.com