Discover the highest money stream administration instruments for small companies. Evaluate platforms like Fathom, Highlight Reporting and Float, and discover ways to select software program that makes planning and forecasting less complicated.

Operating a small enterprise typically means protecting an in depth eye on what’s coming in and what’s going out. From wages and hire to provider funds and tax obligations, money stream is what retains your enterprise transferring. However staying on prime of it isn’t at all times straightforward, particularly when funds arrive late or bills change from month to month.

The best money stream administration software program could make that job so much less complicated. These instruments allow you to monitor, forecast, and perceive your money place so you can also make assured choices about when to restock, deliver on new employees, or spend money on progress.

On this information, we discover how money stream forecasting instruments can help your planning, the advantages they provide, and the way to decide on the one which fits the way in which your enterprise works.

Why money stream forecasting instruments are helpful for small companies

Understanding your money stream doesn’t simply allow you to keep away from frequent money stream errors; it makes day-to-day choices so much simpler. Forecasting instruments take what generally is a handbook and time-consuming job and switch it right into a clearer, extra dependable a part of your planning.

The best software program helps you see what’s taking place together with your money week by week or month by month. You possibly can put together for seasonal slowdowns, plan for giant bills, and make knowledgeable choices about when to spend or save. Many house owners additionally discover these instruments make conversations with lenders or advisors simpler as a result of the knowledge is constant and updated.

When forecasting depends on guesswork or outdated spreadsheets, small points can escalate shortly. A late fee, an surprising invoice, or an upcoming tax obligation can put stress on every little thing from paying employees to ordering inventory. Money stream instruments allow you to spot these gaps early and regulate earlier than they have an effect on your operations.

In case your forecast highlights a shortfall between money coming in and going out, versatile funding can assist you handle that hole. In these conditions, a small enterprise mortgage can help your money stream and future plans.

The distinction between money stream instruments and accounting software program

Most accounting platforms, together with Xero, MYOB, and QuickBooks On-line, now supply some degree of money stream forecasting, though the options differ relying in your plan. Typically, these built-in instruments present a short-term view of your funds, which will be sufficient for day-to-day monitoring.

Devoted money stream software program goes a step additional. It means that you can take a look at totally different situations, mannequin future progress, and see how adjustments in your enterprise may have an effect on your money place over time. When evaluating choices, verify which accounting programs they combine with. Sturdy integrations hold your forecasts up to date robotically, cut back handbook work, and assist minimise errors.

Money stream software program choices

Each enterprise manages money stream a bit of in another way. Some house owners like the flexibleness of constructing their very own spreadsheets, whereas others choose software program that connects to their accounting system and updates robotically. Happily, there’s a device to swimsuit each strategy: from easy templates that supply full management, to smarter platforms that flip your monetary information into clear, real-time insights.

We all know you don’t have time to check each platform your self, so we’ve executed the legwork for you. Beneath, you’ll discover a breakdown of 5 important money stream administration instruments out there in New Zealand, in contrast by the factors that matter most to enterprise house owners. This can allow you to work out which possibility suits finest, whether or not you get pleasure from constructing your individual spreadsheets or need one thing extra automated.

1. Guide Spreadsheets (Google Sheets / Microsoft Excel)

When you’re assured working with numbers, spreadsheets like Microsoft Excel or Google Sheets stay one of the vital versatile and cost-effective methods to forecast money stream. They offer you full management over how your information is laid out and make it straightforward to regulate for your enterprise’s explicit earnings and expense setup.

Many small companies begin with spreadsheets as a result of they’re easy, acquainted, and infrequently already out there by means of Google Workspace or Microsoft Workplace. In addition they present the direct impression of adjustments akin to new hires, pricing shifts, or provider prices with out counting on additional software program purchases.

Spreadsheets do want handbook updates, however that hands-on strategy will be helpful for understanding the place your cash goes and the way every line merchandise impacts your money place. For a lot of house owners, it’s a sensible method to get a deal with on the numbers earlier than transferring to automated instruments.

Free money stream forecast templateProspa has a free money stream forecast template based mostly on the identical construction accountants use with their small enterprise purchasers. It’s designed to assist New Zealand small enterprise house owners monitor earnings and bills throughout a 12-month interval. Obtain the free Excel template and observe the following pointers in our companion article on the best way to forecast money stream to your small enterprise. |

|---|

- Finest for: Those that choose to handle their very own funds and wish full management and adaptability.

- Ease of use: Straightforward. So long as you could have fundamental spreadsheet information.

- Integrations: None (handbook entry).

- Multi-Forex: Guide.

- Typical value: Google Sheets – Free. Microsoft 365 Enterprise Primary begins from NZ$7.10 per 30 days (paid yearly). Study extra

- Free trial: 30 days.

2. Fathom

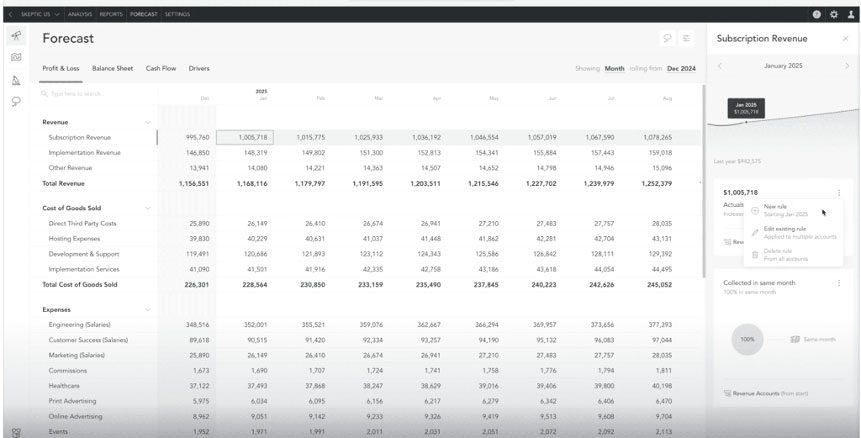

Fathom goes past fundamental forecasting that will help you perceive your enterprise efficiency in additional element. Its key power is combining monetary evaluation, KPI monitoring, and state of affairs planning in a single platform, providing you with clearer perception into what’s shaping your money place.

The platform connects to your accounting software program and robotically imports your information to create a three-way forecast that hyperlinks your revenue and loss, steadiness sheet, and money stream. This provides you a whole view of how your enterprise is performing and the place your money place could also be heading.

Alongside forecasting, Fathom helps you measure progress towards targets with detailed KPI dashboards and visible experiences that flip advanced monetary info into insights you may share together with your staff or accountant. Its state of affairs modelling instruments allow you to discover how choices akin to adjusting pricing or increasing your staff may affect your outcomes over time.

Whereas accountants and advisors typically use Fathom, many rising SMEs additionally use it on to help planning and technique discussions. It could possibly take a while to arrange, and smaller companies might discover it gives extra options than they want daily.

- Finest for: Companies that need deeper evaluation and visible reporting to help long-term planning.

- Ease of use: Average. Intuitive as soon as arrange, however advantages from some monetary information.

- Integrations: Xero, QuickBooks, MYOB, Excel, Google Sheets.

- Multi-Forex: Sure.

- Typical value: From NZ$65 per 30 days, relying on the variety of firms. View pricing

- Free trial: 14 days.

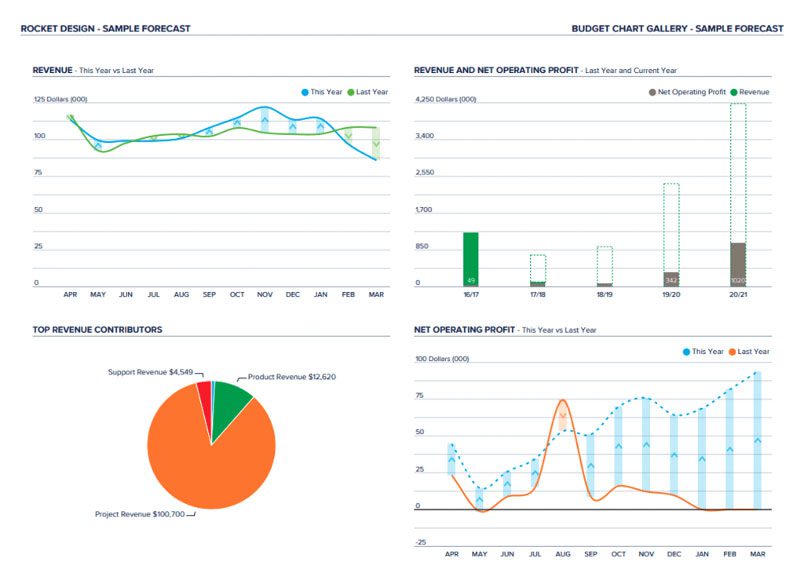

3. Highlight Reporting

Highlight Reporting is designed for companies that want formal, board-ready experiences and clear visible dashboards. It transforms your accounting information into easy-to-read charts and summaries, making advanced monetary info less complicated to interpret and share together with your accountant, board, or wider staff.

Like Fathom, Highlight produces three-way forecasts that hyperlink your revenue and loss, steadiness sheet, and money stream. Nevertheless, its actual power lies in consolidation and structured reporting.

Highlight is especially useful for rising companies or accounting companies that handle a number of entities, as it could possibly consolidate information from a number of firms into one report. This allows you to mannequin totally different situations and put together complete experiences shortly.

- Finest for: Companies that want consolidated reporting or work intently with accountants and advisors.

- Ease of use: Average to excessive. Intuitive interface, although setup can take time.

- Integrations: Xero, QuickBooks, MYOB, Karbon, Excel, Google Sheets, Google Analytics.

- Multi-Forex: Sure.

- Typical value: From NZ$65 per 30 days.

- Free trial: 14 days.

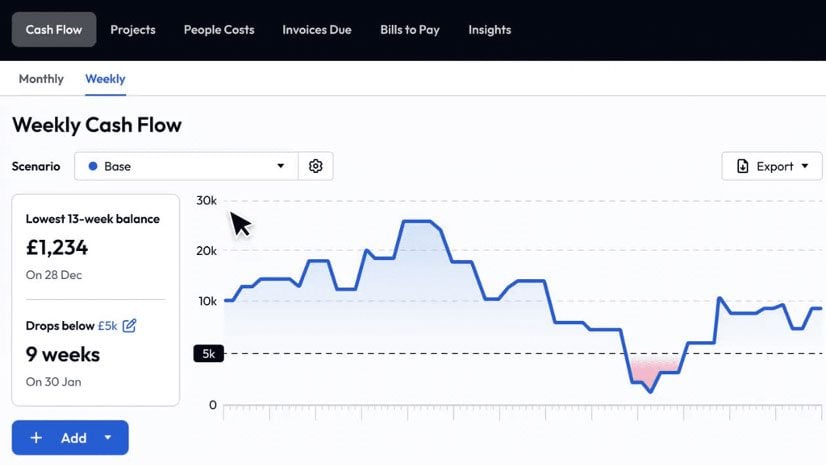

4. Float

Float is a cloud-based money stream device that connects on to your accounting software program, providing you with real-time visibility over your enterprise funds. As soon as it’s arrange, it robotically pulls in your invoices, payments, and financial institution transactions, and updates your forecast as these numbers change.

The platform is designed to be straightforward to make use of, with clear charts and easy state of affairs planning instruments that allow you to take a look at adjustments earlier than they occur. You possibly can see a reside view of your money place and discover “what if” situations, akin to hiring a brand new staff member or taking over an additional order. For a lot of small companies, it’s a simple method to keep on prime of short-term money wants with out constructing advanced spreadsheets.

Float works finest for companies already utilizing Xero, QuickBooks On-line, or FreeAgent. It’s much less appropriate in the event you’re used to handbook spreadsheets, and your forecasts will solely be as correct because the accounting information flowing into the system. Float’s platform is available in New Zealand, though its plans are billed in AUD.

- Finest for: Companies that need automated forecasting and easy visible experiences with out constructing spreadsheets.

- Ease of use: Straightforward. Designed for non-accountants and straightforward to study.

- Integrations: Xero, QuickBooks, FreeAgent.

- Multi-Forex: No.

- Typical value: Ranging from A$39 per 30 days, relying on income (paid yearly). View pricing

- Free trial: 14 days.

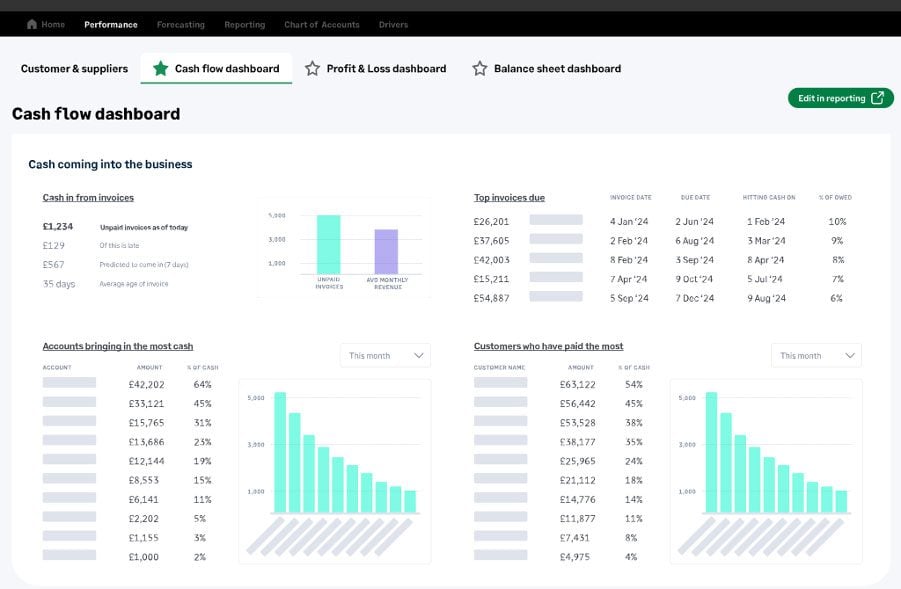

5. Futrli by Sage

Futrli by Sage offers enterprise house owners a transparent view of their efficiency and money stream in a single place. Just like the instruments above, it additionally connects together with your accounting software program to trace each day money stream, forecast future earnings and bills, and present how choices in the present day will have an effect on your revenue and steadiness sheet within the months forward.

Nevertheless, the platform stands out for its superior flexibility and long-range views. You possibly can merge a number of entities, forecast in several currencies, and even mannequin HR adjustments akin to new hires or payroll tax changes. Its customisable dashboards and experiences make it straightforward to observe the metrics that matter most to your enterprise, whether or not you need a snapshot of money stream or a longer-term forecast.

Futrli is suited to rising companies and accountants who want detailed, data-driven forecasts however nonetheless need an interface that’s easy to arrange and interpret. It’s constructed for extra detailed, long-range planning, and its multi-entity and HR forecasting options make it a powerful selection for companies planning to scale. Once more Futrli can be out there in New Zealand, though its plans are billed in AUD.

- Finest for: Companies that need detailed forecasting with a lot of flexibility.

- Ease of use: Average. The dashboards are intuitive, however the superior options require time to arrange and study.

- Integrations: Sage, Xero, QuickBooks, Excel.

- Multi-Forex: Sure.

- Typical value: Ranging from A$55 per 30 days. View pricing

- Free trial: 14 days.

Money stream Forecasting Instruments Comparability

| Device | Finest for | Ease of use | Integrations | Multi-Forex | Typical Value | Free trial |

|---|---|---|---|---|---|---|

| Google Sheets / Microsoft Excel | Managing personal funds

Management and adaptability |

Straightforward | None

(handbook entry) |

Guide | Google: Free

Excel: from NZ$7.10 pm |

30 days |

| Fathom | Deeper evaluation

Visible experiences Lengthy-term planning |

Average | Xero, QuickBooks,

MYOB, Excel |

Sure | From NZ$65 pm | 14 days |

| Highlight Reporting | Consolidated reporting

Working with accountants/advisors |

Average

to excessive |

Xero, QuickBooks, MYOB, Karbon, Excel, Google Sheets, Google Analytics | Sure | From NZ$65 pm | 14 days |

| Float | Automated forecasting

Easy visible experiences |

Straightforward | Xero, QuickBooks, FreeAgent | No | From A$39 pm | 14 days |

| Futrli by Sage | Superior state of affairs planning

Detailed long-range forecasting Versatile reporting |

Average | Sage, Xero,

QuickBooks, Excel |

Sure | From A$55 pm | 14 days |

| What about CashManager? |

|---|

| Whereas most accounting platforms solely present short-term money stream views, the favored homegrown NZ answer CashManager stands out with forecasting capabilities that reach into the long run.

It’s price noting that whereas it does forecasting, it’s nonetheless not a devoted money stream device, so companies needing state of affairs modelling, progress planning, or multi-entity consolidation ought to nonetheless discover the choices above. |

Holding your money stream in verify

Each small enterprise is totally different, and so are their money stream wants. What they share is the necessity to plan forward and keep accountable for cash coming in and going out. Whether or not you want working in spreadsheets or choose software program that updates robotically, selecting the best money stream administration device may give you a clearer view of how cash strikes by means of your enterprise.

With that visibility, it turns into simpler to make proactive choices, from restocking stock to exploring new alternatives. And in the event you want additional flexibility to easy out short-term gaps in money stream, we can assist.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our publication, and be a part of our rising group at nextbusiness24.com