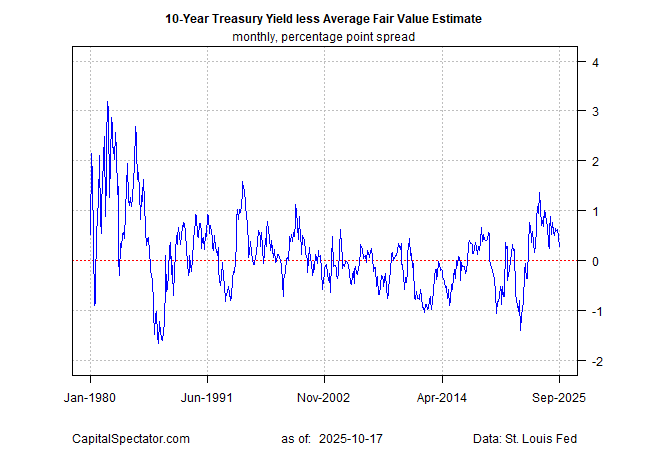

The unfold for the US 10-year Treasury yield over a “truthful worth” estimate has narrowed to the smallest hole in a yr, based mostly on the common estimate for three fashions run by CapitalSpectator.com.

The newest evaluation, which is month-to-month and displays numbers by way of September, displays an ongoing decline out there premium this yr. The present truthful worth estimate for the 10-year yield is 3.85%, which is 27 foundation factors under the market’s common 4.12% fee in September.

The newest downturn out there premium over the truthful worth estimate extends a draw back development that’s been unfolding in current historical past. The downshift highlights a mean-reversion tendency within the 10-year yield’s shifting premium and reductions relative to the truthful worth estimate. For the foreign money cycle, the premium peaked at almost 1.4 proportion level in late-2023.

Remember the fact that the most recent estimate displays modeling that’s lacking a number of financial information factors as a result of authorities shutdown. For instance, the September replace on shopper inflation, which was scheduled for launch earlier this week, has been delayed. The lacking numbers to this point have had a minimal impact on common truthful worth analytics attributable to using three fashions that use a variety of financial and market information. Presumably the federal government will reopen quickly and publish the delayed reviews will likely be issued. Shortly after, we’ll re-run the evaluation and current an up to date truthful worth report.

How is recession danger evolving? Monitor the outlook with a subscription to:

The US Enterprise Cycle Danger Report

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our publication, and be part of our rising neighborhood at nextbusiness24.com