US crude oil fell on Wednesday to a stage that’s under the worth on June 13, when the Israel-Iran battle began. “There may very well be hiccups alongside the best way, however the market is saying this (battle) is probably going over,” Robert Yawger, commodities specialist at Mizuho Securities, informed CNN Tuesday. “Markets breathed a sigh of aid following Trump’s ceasefire declaration, however the celebration may very well be short-lived,” mentioned Lukman Otunuga, senior market analyst at FXTM, in a word to traders. “If tensions flare once more or the ceasefire is violated, we may see a swift return to threat aversion — boosting protected havens like gold and pressuring world equities.”

President Trump is contemplating naming the following Federal Reserve chief early, The Wall Avenue Journal stories: “President Trump’s exasperation over the Federal Reserve’s take-it-slow strategy to reducing rates of interest is prompting him to contemplate accelerating when he’ll announce his choose to succeed Chair Jerome Powell, whose time period runs for an additional 11 months.”

New US residence gross sales fell sharply in Might, falling 13.7% in contrast with April. The extent is 6.3% decrease than in Might 2024. “The massive fall in new residence gross sales in Might cancels out all the positivity of the previous couple of months and serves as a worthwhile reminder that purchaser exercise can solely rise to this point with mortgage charges hugging 7%,” wrote Bradley Saunders, an economist at Capital Economics.

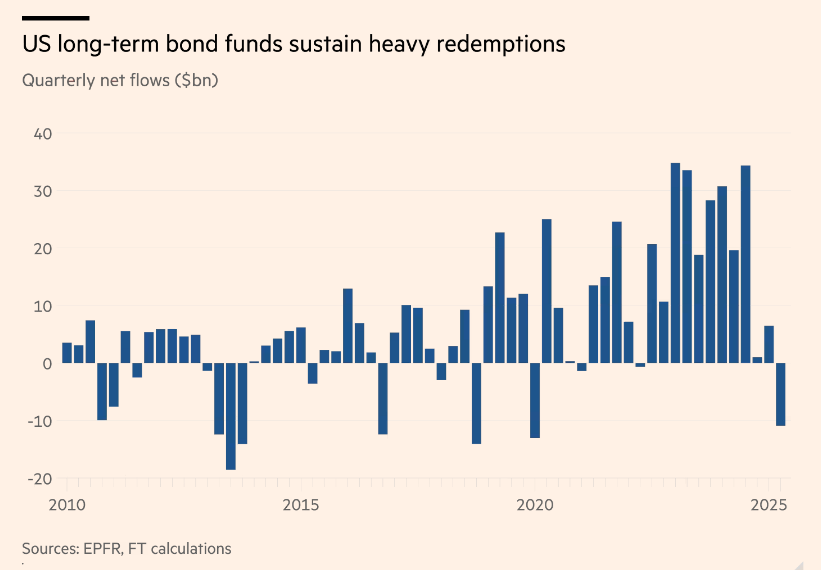

Investors are fleeing long-term US bond funds on the swiftest fee for the reason that top of the Covid-19 pandemic 5 years in the past, stories Monetary Occasions. America’s surging debt load is taken into account a key issue. Web outflows from long-dated US bond funds holding authorities and company debt have reached almost $11 billion within the second quarter, in accordance with evaluation by Monetary Occasions primarily based on EPFR information. “[The fund outflows are] a symptom of a a lot greater downside. There may be a variety of concern domestically and from the overseas investor neighborhood about proudly owning the lengthy finish of the Treasury curve,” mentioned Invoice Campbell at DoubleLine, a bond supervisor.

Keep forward of the curve with Enterprise Digital 24. Discover extra tales, subscribe to our publication, and be a part of our rising neighborhood at nextbusiness24.com