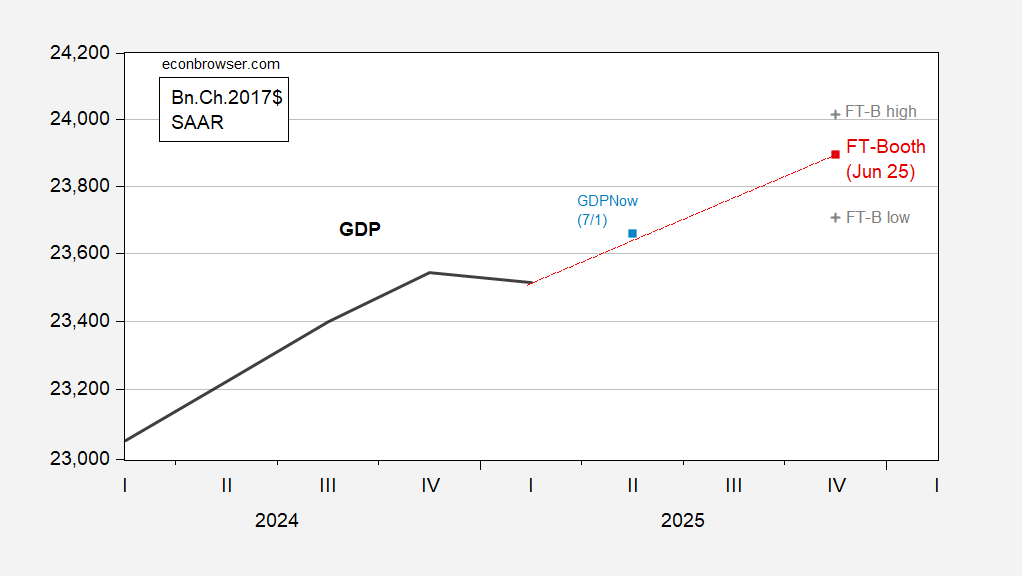

Survey outcomes right here, FT article . GDP degree extra optimistic than Could SPF.

Determine 1: GDP (daring black), FT-Sales space June 2025 survey median (pink sq.), GDPNow of seven/1 (mild blue sq.), Survey of Skilled Forecasters Could 2025 survey median (tan line), all in bn.Ch.2017$ SAAR. Supply: BEA 2025Q1 third launch, FT-Sales space June survey, Atlanta Fed, Philadelphia Fed, and writer’s calculations.

Notice that the FT-Sales space survey is significantly extra optimistic relating to the extent of GDP than the Could SPF median.

Determine 2: GDP (daring black), FT-Sales space June 2025 survey median (pink sq.), tenth percentile (grey +) ninetieth percentile (grey+), GDPNow of seven/1 (mild blue sq.), all in bn.Ch.2017$ SAAR. Supply: BEA 2025Q1 third launch, FT-Sales space June survey, Atlanta Fed,and writer’s calculations.

Whereas the FT-Sales space median is above the Could SPF median, the ten/90 percentile band encompasses the SPF.

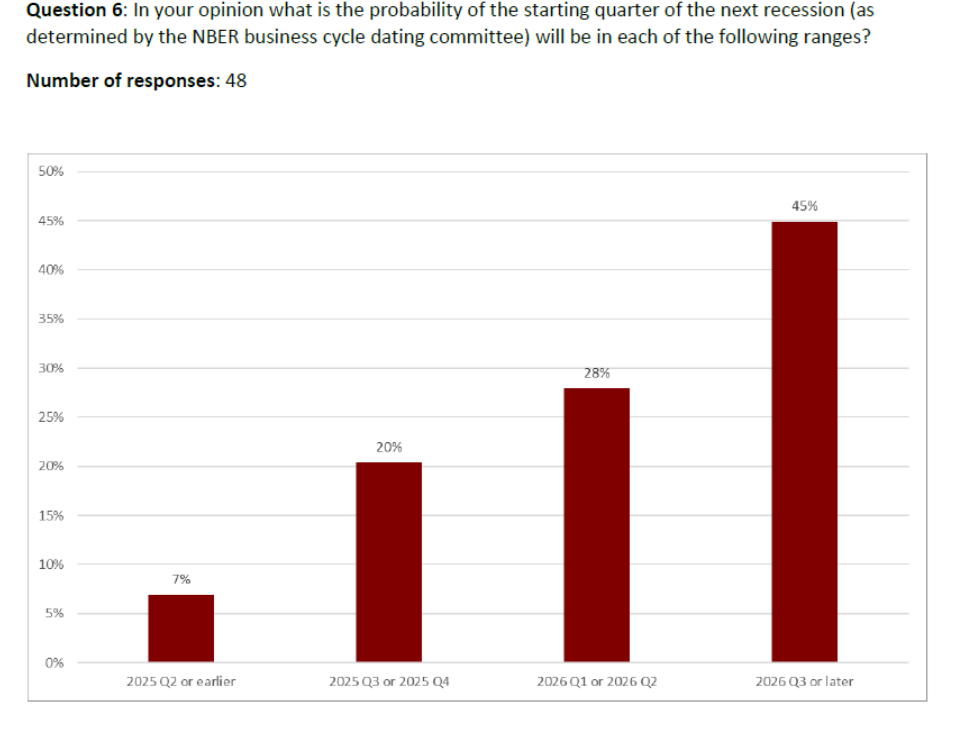

The FT-Sales space survey respondents appear to assume a recession has been moved again (2026q3 or later has risen from 39% in March to 45% in June.

My modal response was 2026Q1-Q2.

The macroeconomists have been additionally queried in regards to the prospects for the greenback’s protected haven facet.

I’m one of many 32%.

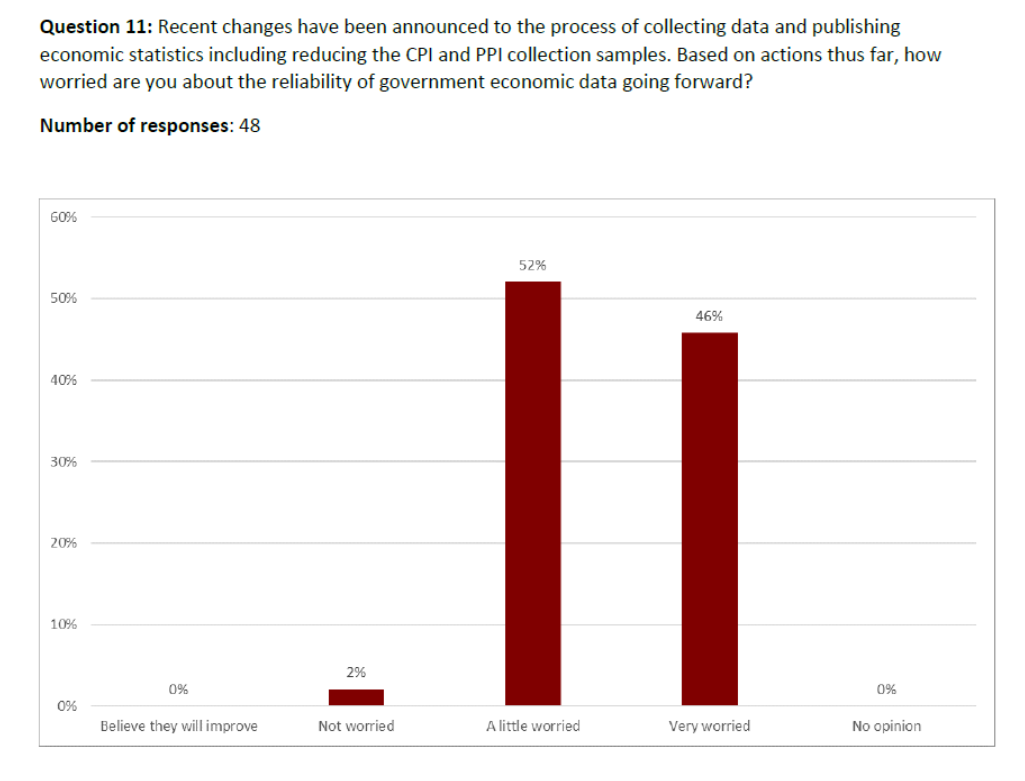

Lastly, with respect to financial knowledge assortment.

Apparently, loads of macroeconomists are involved about degradation of the collection the BLS collects relating to costs. I’d’ve thought the proportion can be greater for “very anxious”, however not less than no person was delusional sufficient to “consider they are going to enhance”. On condition that the CPI enters into every part from Social Safety profit calculations to TIPS yields, we should always all be involved.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our publication, and be part of our rising neighborhood at nextbusiness24.com