How AI-Powered Trading and Retail Investors Are Shaping Global Markets in 2025

In 2025, the global financial markets are more dynamic and technology-driven than ever. The battle between retail investors and artificial intelligence (AI) trading systems is reshaping how money moves, who profits, and what the future of investing looks like. As AI becomes more accessible and retail investors grow more sophisticated, the question stands: Who’s really winning the market in 2025?

This article dives deep into the latest trends, statistics, and real-world examples to uncover how AI-powered trading and retail investors are influencing the financial landscape. Whether you’re an individual investor, a fintech enthusiast, or a market observer, understanding this evolving rivalry is key to navigating the markets today.

The Rise of Retail Investors: More Powerful Than Ever

Retail investors everyday individuals trading stocks, ETFs, crypto, and more have seen a remarkable surge in influence over the past few years. In 2025, they are not just passive participants; they are active market shapers.

Key Drivers Behind Retail Growth

- Technology and Access:

Trading platforms and apps have made it easier than ever for individuals to access markets, execute trades in real-time, and manage diverse portfolios. - Community and Social Trading:

Social platforms now allow investors to share strategies, discuss trends, and even mirror the trades of successful peers. This community-driven approach amplifies the collective power of retail investors. - Alternative Assets:

Retail traders are expanding beyond traditional stocks and forex, investing in fractional real estate, NFTs, and tokenized commodities, making portfolios more diversified and resilient.

Retail Investment Statistics in 2025

- US retail investment rose 13% year-over-year in Q1 2025, reaching $9.8 billion, despite macroeconomic uncertainty.

- Grocery-anchored centers accounted for nearly one-third of all multi-tenant retail deals, with institutional interest quadrupling from Q1 2024.

- Urban retail remained strong, with major acquisitions in cities like New York and Boston by brands such as Uniqlo and Apple, signaling robust demand for prime locations.

Retail Investors’ New Tools

Retail traders are now leveraging:

- AI-driven insights

- Automated trading bots

- Predictive analytics

- Gamified learning platforms

These tools were once exclusive to institutional players but are now democratizing access to advanced trading strategie.

AI Trading: The New Market Superpower

Artificial intelligence has fundamentally changed how trading is done. In 2025, AI trading is not just for Wall Street giants; it’s everywhere from hedge funds to the smartphones of retail investors.

How AI Trading Works

AI trading systems use algorithms to:

- Analyze vast amounts of market data in real time

- Identify patterns and trends invisible to the human eye

- Execute trades automatically, often within milliseconds

- Continuously learn and adapt to new information

AI’s Edge Over Traditional Trading

- Speed:

AI can process and act on data far faster than any human trader. - Emotionless Decisions:

AI systems don’t panic or get greedy; they stick to data-driven strategies. - Scalability:

AI can monitor thousands of assets and markets simultaneously.

AI Tools for Retail Investors

In 2025, retail investors have access to:

- Robo-advisors that build and adjust portfolios automatically

- AI-powered sentiment analysis that gauges market mood from news and social media

- Automated trading bots that execute trades based on set parameters

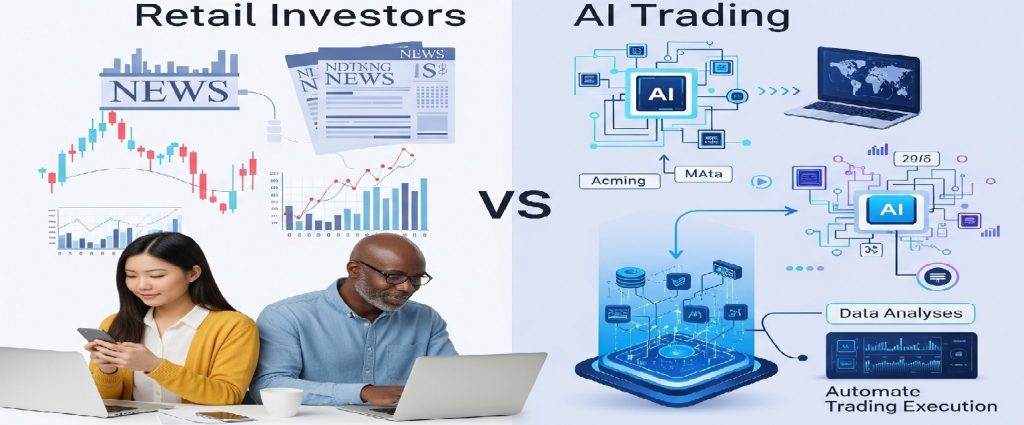

Retail Investors vs. AI Trading: A Side-by-Side Comparison

| Feature | Retail Investors (2025) | AI Trading Systems (2025) |

|---|---|---|

| Decision-making | Community-driven, emotional, sometimes social | Data-driven, emotionless, algorithmic |

| Speed | Minutes to hours | Milliseconds to seconds |

| Tools | Apps, social trading, basic AI, gamification | Advanced algorithms, machine learning |

| Market Impact | Significant in certain assets and trends | Dominant in high-frequency and large-scale |

| Accessibility | High, open to anyone with internet access | Increasingly accessible, but still technical |

| Adaptability | Fast learning, peer collaboration | Self-learning, adapts to new data |

Who’s Winning the Market in 2025?

The Case for Retail Investors

Retail investors are more empowered than ever. With advanced tools, social platforms, and access to alternative assets, they are driving market trends and sometimes even moving entire sectors. For example, the surge in urban retail investments and the popularity of grocery-anchored centers in the US show that retail capital can shape real estate markets.

Community-driven investing, where individuals band together to influence stocks or assets, has become a powerful force. Retail investors also benefit from increased regulatory protections and educational resources, making markets more inclusive and less risky for newcomers.

The Case for AI Trading

AI trading systems still hold significant advantages in speed, scale, and precision. They dominate high-frequency trading, options markets, and complex arbitrage strategies that are simply out of reach for most individuals.

AI-powered robo-advisors and automated trading bots are also leveling the playing field, giving retail investors access to professional-grade strategies. However, the most advanced AI systems remain in the hands of large institutions with the resources to develop and maintain them.

The Reality: Collaboration, Not Just Competition

The real story of 2025 is not just retail investors versus AI trading, it’s the blending of both worlds. Retail investors are using AI tools, and AI-driven platforms are being designed with retail users in mind. This hybrid approach is creating a more dynamic, inclusive, and resilient market.

Trends Shaping the Future

1. Decentralized Finance (DeFi) and Blockchain

Blockchain technology is making markets more transparent and accessible. Decentralized exchanges allow peer-to-peer trading, reducing reliance on traditional brokers and enabling fractional ownership of assets.

2. Gamification and Interactive Learning

Trading platforms are using gamification to make investing more engaging and less intimidating. Interactive simulations and AI-driven coaching help new investors build skills without risking real money.

3. Regulatory Changes

Governments and regulators are responding to the rise of retail investing and AI trading with new policies on transparency, high-frequency trading, and crypto assets. These changes are designed to protect investors and ensure fair play.

4. Alternative Assets Go Mainstream

Fractional real estate, NFTs, and tokenized commodities are now part of mainstream portfolios, giving investors more ways to diversify and hedge against market volatility.

Real-World Examples

- Uniqlo’s $352.5M purchase of its Fifth Avenue flagship and Apple’s $88M deal in Boston highlight how both institutional and retail capital are targeting prime urban retail assets.

- Grocery-anchored retail centers attracted $531 million in acquisitions by REITs, with institutional interest quadrupling from the previous year.

- Social trading platforms are seeing record engagement, with more investors mirroring the moves of top performers and using AI-driven sentiment analysis to guide decisions.

What It Means for Investors

For Retail Investors

- Stay Informed:

Use AI-driven insights and social platforms to keep up with market trends. - Diversify:

Explore alternative assets and new markets to spread risk. - Embrace Technology:

Leverage robo-advisors, automated trading bots, and gamified learning tools to enhance your strategy.

For Institutions and AI Traders

- Innovate Responsibly:

Ensure AI systems are transparent and fair, and adapt to new regulations. - Collaborate with Retail:

Design platforms and tools that empower individual investors, creating a more inclusive market ecosystem.

In 2025, the line between retail investors and AI trading is blurring. Retail investors are more powerful and informed, thanks to technology and community-driven insights. AI trading systems continue to set the pace in speed and efficiency but are increasingly accessible to everyone.

The real winners are those who adapt, learn, and leverage the best of both worlds. As markets continue to evolve, expect even more innovation, collaboration, and opportunity for investors of all sizes.

Key Takeaways

- Retail investors and AI trading systems are both shaping the market in 2025, often working together rather than in opposition.

- The US retail investment market grew 13% year-over-year in Q1 2025, with strong demand for urban and grocery-anchored retail assets.

- AI tools are now accessible to retail investors, democratizing advanced trading strategies.

- Trends like DeFi, gamification, and alternative assets are making markets more inclusive and dynamic.

- The future belongs to those who combine technology, community, and smart strategy.

This article is for informational purposes only and does not constitute financial advice. Always conduct your own research or consult a professional before making investment decisions.

For more insights and updates on global business trends, visit www.nextbusiness24.com

#AITrading #RetailInvestors #Finance2025 #MarketTrends #Fintech #BDigit24 #BDigit24France #BDigit24Europe #BDigit24India