COFER information is out for Q2. With estimated gold held by the central banks, now we have this image of reserve composition.

Determine 1: USD shares of fx (blue bars), EUR (tan), all different (grey). USD(EUR) share assumes 60%(35%) of unallocated reserves are in USD(EUR). Supply: IMF COFER, and writer’s calculations.

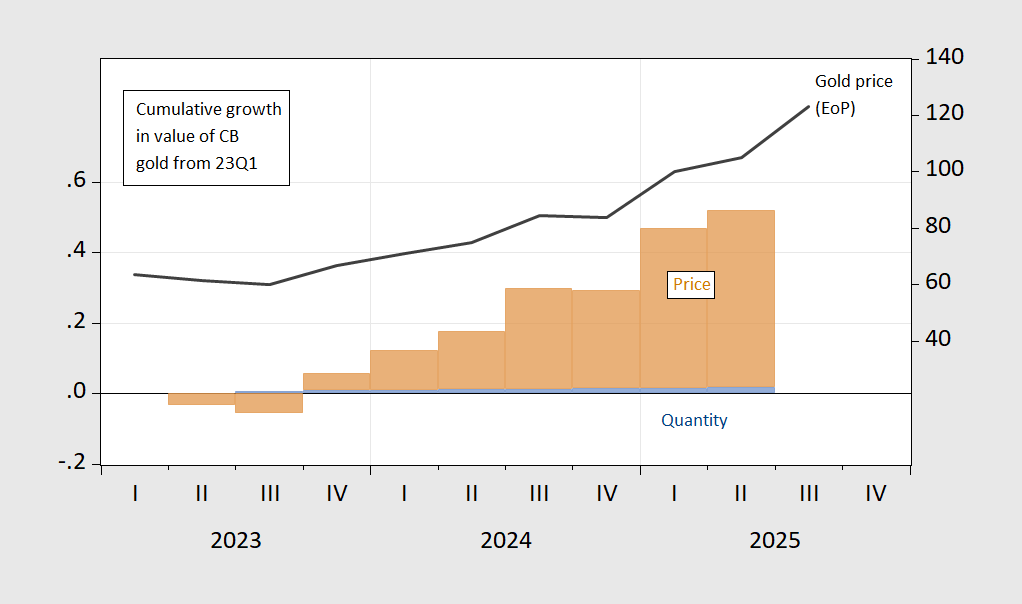

Notice that the rise in gold holding shares of worth is pushed primarily by the rise in gold costs, moderately than quantity of gold. That is proven in Determine 2, the place the change within the worth of gold reserves relative to 2023Q1 is decomposed into worth and amount parts, together with the value of gold index (proper facet).

Determine 2: Cumulative progress in worth of gold held by central banks (brown bar), and in amount of gold (blue bar), relative to 2023Q1. 2025Q2 gold is reported acquisitions added to 2025Q1 portions, multiplied by implied gold worth index. Supply: COFER, Gold Council to 2025Q1, 2025Q2-Q3 calculations by writer primarily based on Gold Council information.

The rise in gold holding shares is primarily attributable to valuation modifications moderately than amount modifications. With a Q3 enhance in gold costs of 17% (not annualized), this distinction is especially essential.

For an evaluation of particular person central financial institution conduct with respect to gold (as much as 2022), see Chinn, Frankel and Ito (2025).

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be part of our rising group at nextbusiness24.com