From IMF’s July World Financial Outlook, launched immediately:

Determine 1: GDP (daring black), CBO present legislation projection of January (tan), implied CEA forecast utilizing CBO present legislation (pink squares), imply forecast from July WSJ survey (gentle blue line, x), July WEO (gentle inexperienced triangle), all in bn.Ch.2017$ SAAR. Supply: BEA 2025Q1 third launch, CBO January 2025, CEA (2025), WSJ survey, and creator’s calculations.

The IMF WEO trajectory relies on this forecast:

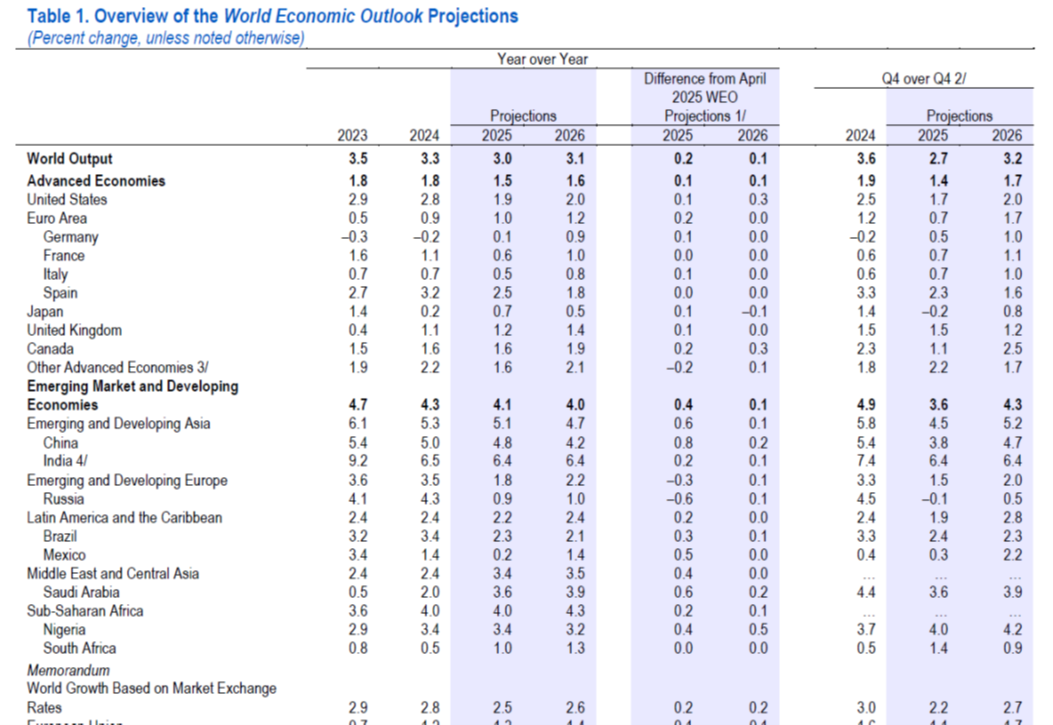

Supply: IMF, WEO July 2025 replace.

From the report:

International development is projected at 3.0 % for 2025 and three.1 % in 2026. The forecast for 2025 is 0.2 proportion level larger than that within the reference forecast of the April 2025 World Financial Outlook (WEO) and 0.1 proportion level larger for 2026. This displays stronger-than-expected front-loading in anticipation of upper tariffs; decrease common efficient US tariff charges than introduced in April; an enchancment in monetary situations, together with resulting from a weaker US greenback; and financial growth in some main jurisdictions. International headline inflation is anticipated to fall to 4.2 % in 2025 and three.6 % in 2026, a path just like the one projected in April. The general image hides notable cross-country variations, with forecasts predicting inflation will stay above goal in the USA and be extra subdued in different giant economies.

Dangers to the outlook are tilted to the draw back, as they have been within the April 2025 WEO. A rebound in efficient tariff charges might result in weaker development. Elevated uncertainty might begin weighing extra closely on exercise, additionally as deadlines for added tariffs expire with out progress on substantial, everlasting agreements. Geopolitical tensions might disrupt international provide chains and push commodity costs up. Bigger fiscal deficits or elevated threat aversion might elevate long-term rates of interest and tighten international monetary situations. Mixed with fragmentation considerations, this might reignite volatility in monetary markets. On the upside, international development could possibly be lifted if commerce negotiations result in a predictable framework and to a decline in tariffs. Insurance policies have to carry confidence, predictability, and sustainability by calming tensions, preserving value and monetary stability, restoring fiscal buffers, and

implementing much-needed structural reforms.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be a part of our rising group at nextbusiness24.com