Operating a hospitality enterprise in Aotearoa has by no means been more difficult. Rising provider prices, unpredictable foot visitors, and staffing shortages can shortly flip money move right into a day by day strain level. However with the fitting methods, hospitality homeowners can keep agile, shield their margins, and discover low-risk methods to develop.

This information shares sensible techniques for small hospo companies to take management of money move, from monitoring efficiency in actual time to exploring funding choices that assist maintain issues shifting.

What’s driving money move stress in Aotearoa’s hospitality sector

Small hospitality companies throughout New Zealand are feeling the pinch in 2025. Wholesale meals and beverage costs have climbed steadily, and utilities like energy and fuel are eroding margins.

Many venues are additionally paying extra to draw and retain employees. Increased hourly charges and incentives are pushing up weekly bills, with out all the time delivering a direct uplift in income. Non permanent and informal employees, typically important throughout peak intervals, could cause unpredictable spikes in payroll, pushing some hospitality operators to search out artistic options.

And whereas diners are returning, foot visitors isn’t all the time constant. Lengthy weekends, college holidays, and main occasions can usher in a surge of income, however quieter intervals typically expose money move gaps when there’s no buffer in place.

How hospo operators keep forward of money crunches

Retaining money move regular in a hospitality enterprise comes right down to small habits that shield margins and enhance visibility.

Run weekly money move check-ins

Shorter money move cycles assist determine points early, particularly in a enterprise with day by day gross sales and fluctuating demand. Search for spending patterns, flag irregularities, and regulate buying or rostering earlier than issues escalate.

Some small venues schedule a weekly 15-minute check-in to assessment financial institution balances, incoming funds, and upcoming payments. It’s a easy routine that improves visibility with out including further admin.

Order inventory based mostly on real-time gross sales

Over-ordering perishables can tie up money and result in waste. Sync your stock with POS knowledge to keep up simply the correct amount of inventory, particularly throughout seasonal shifts or unpredictable lulls.

Some cafés run on a just-in-time stock system, monitoring inventory and staffing wants on a seven-day rolling schedule to cut back holding prices and reply shortly to modifications in demand.

Safe upfront funds the place doable

For catering, capabilities, or massive bookings, ask for a deposit to lock in income and cut back the chance of cancellations or late funds.

It’s frequent for cafés and occasion venues to take a 50% deposit on the time of reserving. This provides them sufficient runway to cowl staffing and ingredient prices prematurely.

Make funds frictionless

Use cell, contactless, or digital fee instruments to hurry up transactions and cut back time-to-cash. Providing versatile choices on the level of sale may also enhance buyer expertise and cut back friction.

Many venues now use transportable EFTPOS machines or QR code funds to streamline the method and enhance desk turnover. Each can assist maintain money shifting persistently.

Use knowledge to form your roster

To keep away from overstaffing throughout quiet shifts or under-resourcing busy ones, use historic gross sales knowledge and forecasts to form your weekly roster, reasonably than counting on intestine really feel.

Some companies use POS-integrated scheduling instruments that flag low-revenue intervals. This helps cut back pointless informal hours earlier than they begin to impression your weekly margins.

Low-risk methods to develop your hospitality enterprise

You don’t want a renovation, rebrand, or second location to develop. For small hospitality companies, essentially the most sustainable features typically come from easy, strategic tweaks to how you use each day.

Prolong service throughout quiet occasions

Search for underused hours in your schedule. Might you trial a late brunch, weekday completely happy hour, or restricted dinner service? Even one or two further service home windows every week can enhance income with out growing overheads.

One Auckland café added a Friday night time dessert bar utilizing the identical staff and prep house. With a small seasonal menu and a comfortable late-night vibe, they drew regular foot visitors from close by eating places and cinemas. What began as a take a look at shortly grew to become one in every of their most worthwhile weekly shifts.

Provide new experiences that draw clients in

Occasions like themed dinners, tasting nights, or hands-on workshops can flip slower evenings into constant income. Think about launching a month-to-month “household recipe night time,” the place your chef shares dishes from her childhood. It offers regulars a purpose to return for one thing contemporary.

Construct partnerships to share the load and enhance publicity

Partnerships can assist hospitality companies increase their attain and add worth with out overextending. Search for alternatives to collaborate with native manufacturers that share your buyer base however provide one thing totally different.

One inner-city café partnered with a close-by boutique resort to offer company with breakfast vouchers. The café gained regular morning foot visitors and the resort added a personalised native contact to its visitor expertise. It was a low-cost, high-impact approach for each companies to spice up visibility and construct loyalty.

Use loyalty applications to encourage repeat visits

Whether or not it’s a free espresso after 5 visits or reductions on off-peak days, loyalty techniques assist maintain your enterprise high of thoughts with out a huge advertising price range.

One artistic method is to supply a dessert passport. Company who attempt 5 totally different sweets obtain a free take-home deal with. It’s a low-pressure strategy to introduce individuals to extra of your menu and provides them a purpose to return.

When you run common occasions, contemplate giving return company early-access bookings or reserved seating. These low-cost perks reward loyalty with out counting on reductions and assist flip informal guests into long-term supporters.

Take a look at concepts on a small scale earlier than going all in

Earlier than committing to a full menu change or gear buy, run a brief trial. Provide a limited-time particular or host a one-off occasion, then measure curiosity and gross sales. This method helps you develop with confidence and reduces your danger when implementing new initiatives.

The most effective instruments for managing money move in hospitality

The precise instruments can provide hospitality homeowners a clearer view of the place cash goes, what’s coming in, and learn how to plan for quieter intervals.

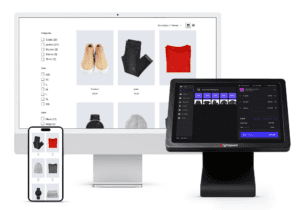

1. Monitor stock and gross sales in actual time.

Platforms like Lightspeed and Sq. sync day by day gross sales with inventory and buyer knowledge. This helps you handle ordering, monitor margins, and regulate rostering based mostly on anticipated demand.

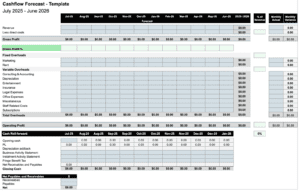

2. Plan short-term money move with easy calculators

The Prospa Money Circulation Forecast Calculator helps you to map out earnings and bills week by week. It’s a sensible strategy to take a look at how seasonal shifts, staffing modifications, or upcoming occasions would possibly have an effect on your capacity to cowl key prices.

3. Forecast seasonal money move modifications

Superior instruments like Float, Fathom, and Highlight Reporting provide real-time visibility over money move, efficiency insights, and built-in three-way forecasting. These instruments are significantly helpful for companies seeking to scale or looking for funding.

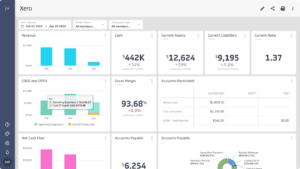

4. Handle bills and funds in a single place

Xero and QuickBooks carry banking, payments, and payroll into one dashboard. This makes it simpler to identify overdue invoices, monitor bills, and keep forward of fee cycles.

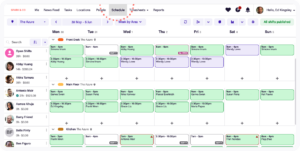

5. Construct rosters that mirror gross sales patterns

With instruments like Deputy, you may create employees schedules based mostly on previous gross sales and anticipated income. If an evening is persistently quiet, the platform helps you cut back pointless hours and shield margins.

How small hospitality companies can fund their subsequent transfer

Whether or not you’re planning one thing new or managing a quiet patch, there are a number of funding choices for hospitality enterprise homeowners, every designed to help totally different money move wants.

Must improve or create new income streams?

Including an outside seating space, refreshing your fit-out, or launching a brand new menu can all elevate income, however most of those concepts require upfront funding.

A Prospa Enterprise Mortgage offers you entry to between $5,000 and $500,000, with mounted repayments and phrases as much as 36 months. It’s a sensible strategy to make enhancements now, whereas spreading the associated fee over time.

Want versatile money to cowl short-term gaps?

Hospitality companies typically really feel the pinch when provider payments arrive simply earlier than the weekend rush or a quiet midweek stretch.

A Prospa Line of Credit score offers you versatile entry to funds whenever you want them. Draw down solely what’s wanted, and pay curiosity on what you employ. It’s effectively suited to overlaying wage runs, restocking earlier than peak intervals, or bridging the hole between paying suppliers and getting paid.

Keep forward of the curve with Enterprise Digital 24. Discover extra tales, subscribe to our e-newsletter, and be a part of our rising group at nextbusiness24.com