June NFP beats consensus on the again of schooling and well being companies employment, whereas personal NFP surprises draw back. With S&P World month-to-month GDP flat during the last six months by way of Could, many key indicators adopted by the NBER Enterprise Cycle Courting Committee (BCDC) are flat or falling (though NBER locations main emphasis on employment, which remains to be rising, together with private revenue).

Determine 1: Nonfarm Payroll incl benchmark revision employment from CES (daring blue), civilian employment utilizing smoothed inhabitants controls (orange), industrial manufacturing (pink), private revenue excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. 2025Q1 GDP is third launch. Supply: BLS through FRED, Federal Reserve, BEA, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/2/2025 launch), and creator’s calculations.

Right here’s an image of some different indicators.

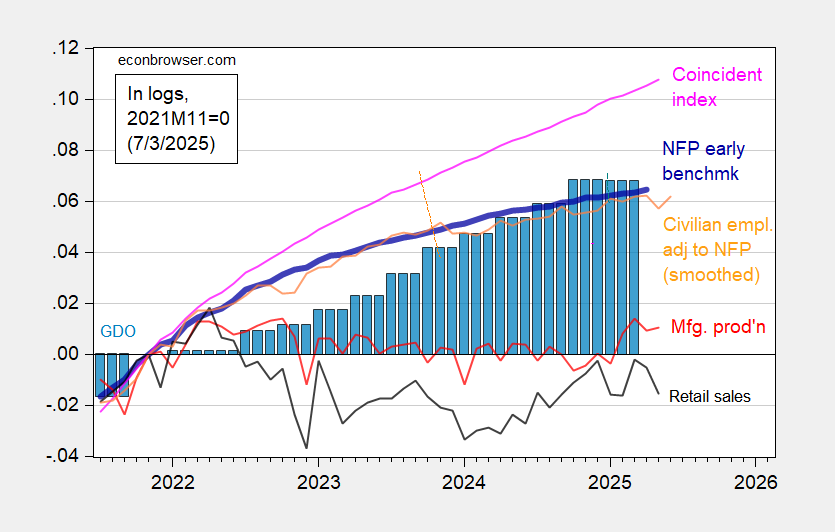

Determine 2: Preliminary Nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted to NFP idea, with smoothed inhabitants controls (orange), manufacturing manufacturing (pink), actual retail gross sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Supply: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve through FRED, BEA 2025Q1 third launch, and creator’s calculations.

Typically, I put a lot heavier weight on the CES vs. CPS measures of employment. Nonetheless, in the event you’re a believer that the CPS sequence alerts recessions sooner than the CES, nicely, carry on worrying (there’s truly solely blended proof in help of this view, utilizing real-time information, see this put up).

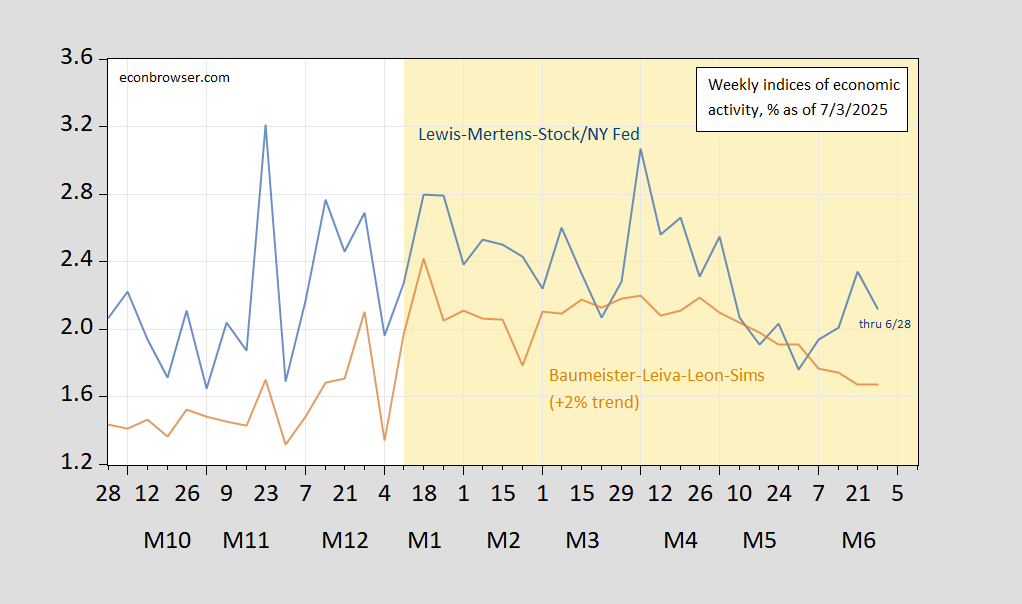

Observe that each one these information are backward wanting, with employment referring to roughly second week in June. Weekly indicators of financial exercise affirm a slowdown beginning in April, persevering with by way of the later a part of June.

Determine 3: Lewis, Mertens, Inventory Weekly Financial Index (blue), and Baumeister, Leiva-Leon, Sims Weekly Financial Situations Index for US plus 2% development (tan), all y/y development charge in %. Supply: Dallas Fed through FRED, WECI, accessed 7/3/2025.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be a part of our rising group at nextbusiness24.com