India’s renewable-energy IPO wave in current months has largely been dominated by firms resembling Vikram Photo voltaic, Saatvik Inexperienced and Emmvee that make photo voltaic modules and provide them to energy builders or EPC contractors. Fujiyama Energy Programs, whose ₹828-crore public difficulty opened on November 13 and shall shut on November 17, is much less of a photo voltaic producer and extra of an rising consumer-energy model. That distinction issues, as it’s a retailer within the distributed-energy market which is an ecosystem that straddles client electronics, batteries, and rooftop photo voltaic installations. Understanding that distinction is important earlier than deciphering its financials or valuation.

The IPO is a mixture of contemporary difficulty of two.63 crore shares aggregating to ₹600 crore and provide on the market of 1 crore shares by promoters aggregating to ₹228 crores. Fujiyama plans to make use of ₹275 crore of IPO proceeds to repay debt (₹433 crore Q1FY26), and ₹180 crore for the Ratlam facility. Promoters are diluting round 11.8 per cent of their stake. The IPO was subscribed 9 per cent on Day-1.

The IPO costs Fujiyama at 45 occasions its FY25 earnings, which is cheaper than client power names resembling Havells (63x) and Servotech Renewable (69x), however costlier than the likes of Amara Raja Power & Mobility (23x) and Oswal Pumps (26x). Not one of the friends, nonetheless, provide an apple-to-apple comparability on account of completely different product portfolios.

Fujiyama’s IPO is healthier approached with warning. Its current earnings don’t but show a sustained step-up, and traders want extra quarters to see whether or not margins maintain as soon as the subsidy-driven rooftop cycle normalises. The enterprise of this small-cap can be uncovered to focus threat, with over 40 per cent of retail gross sales coming from Uttar Pradesh, and to supply-chain volatility given its continued reliance on imported cells, semiconductors, and lithium-ion parts. Model distinctiveness stays untested in a phase dominated by stronger incumbents, whereas rooftop demand itself is policy-sensitive and will soften if subsidies or net-metering guidelines change. These components argue for a wait-and-watch stance till efficiency stabilises.

Enterprise

Fujiyama Energy Programs manufactures and sells a mixture of photo voltaic panels, inverters, batteries, UPS programs, E-rickshaw chargers and lithium-ion batteries. They’re marketed underneath its two manufacturers: UTL Photo voltaic and Fujiyama Photo voltaic. Collectively, they account for greater than 522 stock-keeping items. It has a distribution community of 725 distributors, 5,546 sellers and 1,100 unique “Shoppe” franchisee. Panels and batteries collectively kind about two-thirds of complete income. The photo voltaic UPS/inverter phase provides one other quarter. E-rickshaw chargers and on-line UPS traces stay small however rising.

As of June 2025, it operated 4 manufacturing amenities: Parwanoo (UPS system and solar energy conditioning items a.okay.a PCUs), Higher Noida (photo voltaic panels, inverters, e-rickshaw chargers, lithium-ion batteries), Bawal (panels, tubular batteries), and Dadri (panels). Cumulative put in capacities expanded sharply between FY23 and June 2025, with photo voltaic PCU and UPS capability now 325 MW, photo voltaic inverters 1,084 MW, photo voltaic panels 1,039 MW, lithium-ion batteries 545 MWh, tubular batteries 1,318 MWh, and E-rickshaw chargers 334 MW.

The enterprise is structurally completely different from upstream photo voltaic producers like Waaree or Premier Energies. About 94 per cent of Fujiyama’s income in Q1 FY26 got here from B2C channel. The corporate’s success relies upon extra on model pull, supplier margins, and client financing than on silicon costs or utility-scale tenders. This channel-heavy mannequin explains each its robust attain and its working-capital depth.

Rooftop-solar market

Fujiyama’s IPO timing coincides with an inflection level in India’s rooftop photo voltaic market. In accordance with the CARE Advisory report commissioned by the agency, rooftop installations are anticipated to develop at 40 per cent CAGR from FY25 to FY30, increasing from 17 GW to just about 100 GW. In FY19-25 interval, it grew 45 per cent CAGR. The increase is being pushed by central programmes such because the PM Suryaghar Muft Bijli Yojana, which goals to subsidise rooftop panels for 1 crore households, and state-level incentives.

The corporate’s enterprise is concentrated in North and West India, with Uttar Pradesh accounting for 42 per cent of retail gross sales in Q1FY26. Prime-5 states (UP, Rajasthan, Maharashtra, Punjab and Haryana) account for 77 per cent.

Future growth i.e. the ₹180 crore Ratlam undertaking in Madhya Pradesh, will give it a central-India manufacturing base. The power is designed so as to add 2 GW every of panel and inverter capability and a couple of GWh of lithium-battery capability. That might considerably enhance total output as soon as operational in subsequent 2-3 years.

Nonetheless, the rooftop phase can be probably the most operationally complicated nook of photo voltaic power. Set up will be small, buyer approvals are sluggish, and gross sales cycles are lengthy. This implies increased overheads and cash-flow delays in contrast with utility-scale initiatives. Any coverage change in net-metering (credit photo voltaic power system house owners for the electrical energy they add to the grid) or subsidy disbursement may instantly have an effect on retail demand.

Below the PM Surya Ghar programme, the central subsidy is significant. As per RHP, householders get ₹30,000 per kW for the primary 2 kW and ₹18,000 per kW for the subsequent 1 kW, with the whole payout capped at ₹78,000 for programs above 3 kW. Housing societies and RWAs are eligible for ₹18,000 per kW for widespread amenities (together with EV-charging masses) as much as outlined limits, whereas sure “particular states” obtain an extra 10% subsidy. These incentives materially decrease upfront prices and enhance payback durations, although they’re nonetheless contingent on MNRE compliance and state-level processes. This makes subsidy move and approval timelines a key variable for precise client uptake.

In FY25, Fujiyama had roughly 15.5 per cent share of the Indian solar-battery market and equipped 1.64 GW of photo voltaic inverters, accounting for about 9.6 per cent of inverter capability. These classes command increased margins and buyer stickiness as a result of they’re branded purchases, not commodities. Customers determine with inverter or battery manufacturers, not the module provider. In that sense, Fujiyama competes much less with Waaree or Adani Photo voltaic and extra with Luminous, Microtek, Exide, and Amara Raja Power & Mobility.

To maintain visibility, such enterprise fashions rely closely on supplier commissions and franchise incentives. Promoting and advertising bills at 1.4 per cent of income in FY25 has grown YoY, however stays low in contrast with the three–5 per cent spends typical of established consumer-durable gamers. Fujiyama could have constructed a retail-facing mannequin, however its model funding nonetheless displays a producer’s warning quite than a marketer’s aggression. Sustaining visibility on such lean budgets may check the bounds of its present franchise mannequin and its capability to carry premium pricing, as soon as development normalises.

Financials

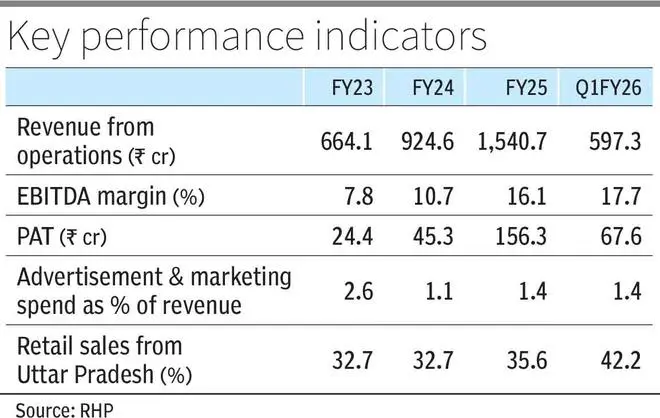

The aggressive scaling underlines why income greater than doubled over two years from ₹664.1 crore in FY23 to ₹1,540.7 crore in FY25, with an extra ₹597.3 crore within the June-quarter FY26 alone. Revenue after tax rose over six-fold from ₹24.4 crore in FY23 to ₹156.3 crore in FY25, and ₹67.6 crore in Q1 FY26, a trajectory few industrial friends can match. EBITDA margin climbed to 16.1 per cent in FY25 and 17.7 per cent in Q1 FY26, from 8-11 per cent in FY23-24.

We consider the above could not symbolize steady-state development. Such speedy growth coincides with a interval of extraordinary business profitability when module and cell costs softened sharply whereas end-consumer pricing remained agency. FY25 return on fairness of 39.4 per cent and return on capital employed of 41 per cent are wonderful by any customary, although partly reflecting cyclical margin peaks.

Working capital stays the important thing vulnerability. Web working capital rose to ₹115.2 crore in FY25 from ₹42 crore in FY24, funded largely by short-term debt that elevated from ₹137 crore to ₹257.8 crore. Liquidity stayed skinny with minimal money balances. Though reported income expanded, the OCF/PAT development is risky—from very robust conversion in FY23 and FY24 (312% and 189%) to solely 12% in FY25, earlier than slipping to –6.7% in Q1 FY26. The current outflow seemingly displays increased stock and prolonged credit score to distributors, however the broader sample exhibits that earnings high quality is tightly linked to working-capital swings, and never but on a secure footing.

Valuation and dangers

The IPO costs Fujiyama at 45 occasions its FY25 earnings, which is cheaper than client power names resembling Havells (63x) and Servotech Renewable (69x), however costlier than the likes of Amara Raja Power & Mobility (23x) and Oswal Pumps (26x). Although Fujiyama earnings have been sturdy for Q1FY26, valuation based mostly on annualising as one quarter shouldn’t be a dependable indicator of full-year earnings.

Fujiyama’s value will hinge on its capability to transform model recall into recurring home demand. For traders, the important thing variable is earnings sustainability of this small-cap firm. If development continues with out working-capital blow-outs, valuation may look conservative in hindsight. It may emerge as one of many large-scale consumer-solar manufacturers, akin to how Voltas or Havells scaled in cooling and electricals. If not, it dangers the destiny of earlier inverter-UPS manufacturers that misplaced floor to bigger conglomerates as soon as the market matured.

Regardless of being positioned as a home producer, Fujiyama stays reliant on imported parts. About 26 per cent of complete purchases in FY25 and 29 per cent in Q1 FY26 have been imported, primarily photo voltaic cells, semiconductors, and lithium-ion cells from China. This publicity is each a price benefit and a strategic threat. A deliberate photo voltaic cell plant at Dadri facility could cut back import dependence marginally, however the shift will take time and capital.

Not like an EPC agency, Fujiyama’s enterprise revolves round its manufacturers “UTL Photo voltaic” and “Fujiyama Photo voltaic.” The RHP lists three emblems, 4 design registrations, and one patent—for its proprietary “rMPPT” energy-harvesting expertise. Nonetheless, the model “Fujiyama” shouldn’t be distinctive globally and will face challenges from unrelated entities. Sustaining model notion in a class crowded by multi-nationals like Luminous and Havells would require regular advertising outlay, sturdy after-sales service, and supplier self-discipline.

The rooftop photo voltaic market is closely policy-driven. Fujiyama and its prospects profit from central and state subsidies that decrease efficient prices. If subsidy disbursals are delayed or lowered, undertaking economics for end-users may weaken, hurting demand. Equally, rooftop-solar economics depend upon net-metering laws, which fluctuate throughout states. Any tightening of those guidelines may cut back client uptake. We consider proper now rooftop development is subsidy-driven, not price-elastic demand.

Revealed on November 13, 2025

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be a part of our rising group at nextbusiness24.com