There are just a few particular issues that set this retail big aside from the competitors.

Shopper-staples shares are among the best-known names on Wall Avenue. Walmart, Coca-Cola, Procter & Gamble, and PepsiCo are all legendary American firms. What’s extra, most of us have at the very least considered one of their merchandise in our houses proper now.

But what about Costco (COST -0.16%)? It is a relative newcomer in contrast with many firms within the shopper staples sector, however there is not any denying its impression and affect. Is it a purchase? Let’s discover out.

Picture supply: Getty Photos.

Attending to know Costco

Let’s begin by answering two central questions in regards to the firm: What does Costco do, and the way massive is it?

To take the second query first, Costco is likely one of the world’s greatest retailers. The corporate operates over 900 warehouse shops throughout 14 international locations, with the vast majority of areas in the US. It boasts a market cap of round $400 billion, making it the second-largest inventory within the shopper staples sector.

The important thing function of Costco’s enterprise mannequin is its membership technique. The corporate limits entry to its shops to members solely, thus gaining a big quantity of income from membership charges.

In 2024, Costco generated $4.8 billion in income from membership charges alone, accounting for roughly 2% of its complete income. Whereas that determine might sound small on a proportion foundation, the membership income is essential, because it accounts for the majority of Costco’s earnings. Certainly, a lot of the firm’s $1.9 billion in internet revenue stems from its high-margin membership charges, enabling it to keep up low retail costs.

The advantages and dangers of proudly owning Costco inventory

There are a number of bullish causes to personal Costco inventory.

To start with, the corporate’s enterprise mannequin provides it a novel aggressive benefit inside the retail sector. Most shops want consumers — and plenty of them — to generate even a bit little bit of revenue. As famous earlier, that is not essentially the case for Costco. The majority of its earnings come from membership charges — whether or not these members flip as much as store or not.

Second, the corporate is not only a retailer; it has its personal private-label merchandise, bought underneath the “Kirkland” label. Roughly one-third of all gross sales at Costco are Kirkland merchandise, which generate extra revenue for the corporate than different merchandise.

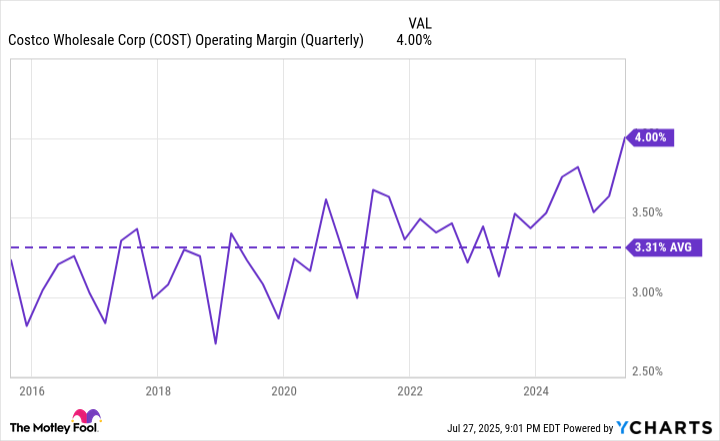

Lastly, the synthetic intelligence (AI) increase may ship large enhancements for an organization like Costco, which operates on comparatively tight margins. For instance, during the last 10 years, it has had a median working margin of round 3%. In latest quarters, that has elevated to 4%. This determine may enhance even additional within the coming years as the corporate introduces new applied sciences, together with humanoid robots, in addition to AI-driven stock administration and logistics.

COST Working Margin (Quarterly) information by YCharts.

On the flip aspect, commerce and tariff issues loom over Costco. Lots of the merchandise bought at any given warehouse originate overseas, making them inclined to tariffs. Along with commerce, shopper spending can shortly dry up, notably if the labor market weakens or inflation as soon as once more picks up. All of those macroeconomic issues pose dangers for the corporate and its shareholders.

Lastly, Costco operates in a extremely aggressive surroundings. Deep-pocketed rivals like Walmart and Amazon are always circling, seeking to take clients and market share from it each time attainable.

Is Costco inventory a purchase now?

The straightforward reality is that Costco is not a inventory for each investor. It is not low-cost; shares commerce at a price-to-earnings (P/E) a number of of 53, which is way greater than most shopper staples shares. However the firm does have attraction due to its enterprise mannequin, which gives a much more dependable type of income than most retailers can depend on. Furthermore, if Costco makes use of AI-powered instruments in a wise approach, its margins may widen, producing far more revenue.

Should you’re a growth-oriented investor, it’s possible you’ll wish to think about Costco inventory. Should you’re a value- or income-oriented investor, it’s possible you’ll be finest served elsewhere.

Jake Lerch has positions in Amazon, Coca-Cola, and Procter & Gamble. The Motley Idiot has positions in and recommends Amazon, Costco Wholesale, and Walmart. The Motley Idiot has a disclosure coverage.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be a part of our rising group at nextbusiness24.com