Present trade traits are working in Carnival’s favor.

Cruise ship operators have been a few of the worst-hit corporations through the pandemic, being compelled to close down. However passengers have been coming again in droves within the years since cruises resumed. That was on show as soon as once more when Carnival Corp. (CCL -1.90%) (CUK -1.36%) reported its tenth straight quarter of file income.

Regardless of the sturdy outcomes and steering, the inventory sank on the report, however it’s nonetheless up about 15% on the 12 months, as of this writing.

Let’s dive into Carnival’s most up-to-date outcomes to see whether or not now is an effective time to purchase the dip.

Picture supply: Getty Pictures

One other file quarter

Carnival posted sturdy fiscal third-quarter outcomes, reporting file income and earnings. As well as, the corporate mentioned reserving volumes proceed to strengthen, with half of 2026 already booked at traditionally excessive costs and 2027 already off to a powerful begin.

For the quarter, Carnival’s income rose 3% to a file $8.15 billion. Ticket income climbed 4% to $5.43 billion, whereas onboard income edged up 2%.

Accessible decrease berth days (ALBDs), a measure of capability based mostly on cabins holding two passengers, fell 2% to 24.6 million. Occupancy, in the meantime, remained at 112%. Occupancy relies on two passengers per cabin, so it will probably exceed 100%. The corporate had much less out there capability than a 12 months in the past and fewer passengers, however sturdy pricing powered income progress.

Internet yields, which measure income minus variable prices (comparable to commissions, transportation, and so forth.) per ALBD, jumped 5% to $249.11. Its gross margin per ALBD rose to $124.20. These metrics present that the corporate is seeing higher margins and profitability per cabin.

Moreover, these metrics helped the corporate produce file web revenue and adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) within the quarter. Adjusted web revenue climbed 10% to $2 billion, whereas adjusted EBITDA jumped 7% to $3 billion. Adjusted earnings per share (EPS) climbed 13% to $1.43.

Carnival has generated about $4.7 billion in working money circulate thus far this 12 months, and $2.6 billion is free money circulate. The latter is an enormous enchancment in comparison with a 12 months in the past, when it was spending extra on capital expenditures (capex) to construct new ships. It had one new ship delivered this 12 months and has none set for subsequent 12 months. The corporate expects so as to add one to 2 new ships a 12 months going ahead.

The mixture of free money circulate and robust profitability helped the corporate scale back its leverage (web debt/adjusted EBITDA) to an anticipated 3.6 occasions by year-end 2025. That may be an enormous enchancment from the 6.7 occasions leverage it carried on the finish of fiscal 2023.

Wanting forward, Carnival is projecting fiscal This fall adjusted web revenue to surge 60% to $300 million. It expects web yields to rise by 6.4%, or 4.3% in fixed forex.

The corporate as soon as once more raised its full-year steering throughout the board, as seen within the desk beneath.

| December Steering | March Steering | June Steering | September Steering | |

|---|---|---|---|---|

| Internet yield progress | 4.2% | 4.7% | 5% | 5.3% |

| Adjusted EBIDTA | $6.6 billion | $6.7 billion | $6.9 billion | $7.1 billion |

| Adjusted EPS | $1.70 | $1.83 | $1.97 | $2.14 |

Supply: Carnival. EBITDA = earnings earlier than curiosity, taxes, depreciation, and amortization. EPS = earnings per share.

Is Carnival a purchase?

One of many greatest points going through Carnival popping out of the pandemic lockdown was that it left the corporate burdened with debt and extremely leveraged. Administration has executed an amazing job of not solely rising income and profitability but additionally decreasing leverage to a extra affordable quantity.

Now, on condition that the cruising market might at all times flip if the financial system weakens, I might nonetheless prefer to see the corporate proceed to decrease its debt. However general, it is taking a pleasant, disciplined strategy to including new ships whereas benefiting from sturdy occupancy and excessive costs. It is also been in a position to increase its credit standing and refinance to lower-cost debt, serving to decrease its curiosity expense.

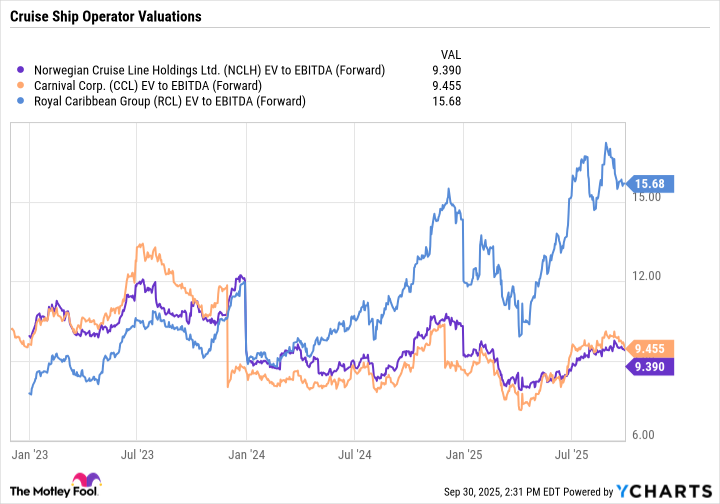

From a valuation perspective, the corporate trades at a ahead enterprise worth (EV)-to-EBITDA a number of of about 9.5. Given the debt and depreciation related to the trade, I desire utilizing this valuation metric when cruise ship inventory, and its valuation is correct according to rival Norwegian Cruise Line and at a reduction to Royal Caribbean.

NCLH EV to EBITDA (Ahead) information by YCharts. EV = enterprise worth. EBITDA = earnings earlier than curiosity, taxes, depreciation, and amortization.

General, I feel Carnival has strong upside potential from right here, given the trade traits, its sturdy bookings, and its capability to proceed deleveraging. In the meantime, its valuation is affordable and has the potential to presumably broaden reasonably. Nonetheless, it is a cyclical inventory that would come underneath strain throughout a recession, so simply pay attention to financial traits.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be part of our rising group at nextbusiness24.com