Apple plans to ramp up investments to catch up in AI developments.

Apple (AAPL 4.24%) has lengthy been one of many premier shares on the U.S. inventory market, spending many of the previous decade because the world’s most dear public firm. Nevertheless, the corporate has seemingly taken a step again previously few years because the synthetic intelligence (AI) growth has boosted the worth of many different massive tech firms.

Previously three years, Apple’s inventory is barely up round 30%, making it the second-worst performer of the “Magnificent Seven” shares (trailing solely Tesla) and underperforming the S&P 500. That is not one thing buyers are used to seeing from Apple.

Regardless of Apple seemingly lagging behind, there might probably be a breath of recent air coming to the corporate, sparking new life into the inventory.

A much-needed rebound for the iPhone and Mac merchandise

Apple’s fiscal third-quarter earnings, for the interval ended June 28, had been a nice shock for many individuals. Its income grew practically 10% yr over yr to $94 billion, which is a June quarter document for the iPhone maker. And talking of iPhone, the smartphone’s income grew 13% yr over yr to $44.6 billion, which Apple famous was pushed by the recognition of the iPhone 16 household.

Mac (which incorporates merchandise like MacBook Professional, MacBook Air, iMac, and Mac Studio) income grew 15% yr over yr to $8 billion, however iPad and wearables, dwelling, and equipment gross sales had been noticeably down — 8% and 9% yr over yr, respectively.

Nonetheless, Apple’s {hardware} income grew by 8% yr over yr and accounted for practically 71% of its complete income for the quarter. Apple’s companies section reached an all-time excessive, bringing in $27.4 billion, however {hardware} stays — and can seemingly stay — king for the corporate.

AAPL Income (Quarterly) knowledge by YCharts

Apple’s year-over-year income progress was its highest previously three years.

Is Apple lastly getting severe about AI?

The large cloud hanging over Apple’s enterprise has been AI (what it calls “Apple Intelligence”), and the dearth of urgency within the area in comparison with rivals like Alphabet and Microsoft. It appears Apple is starting to take it extra critically and tackle this subject.

A significant benefit on Apple’s aspect is the variety of gadgets it has in individuals’s pockets, properties, and workplaces. Ideally, Apple can combine AI into its varied {hardware}, giving individuals much more of a cause to decide on it over opponents. This has been the plan for some time, but it surely hasn’t gone as easily or as shortly as most individuals thought or hoped.

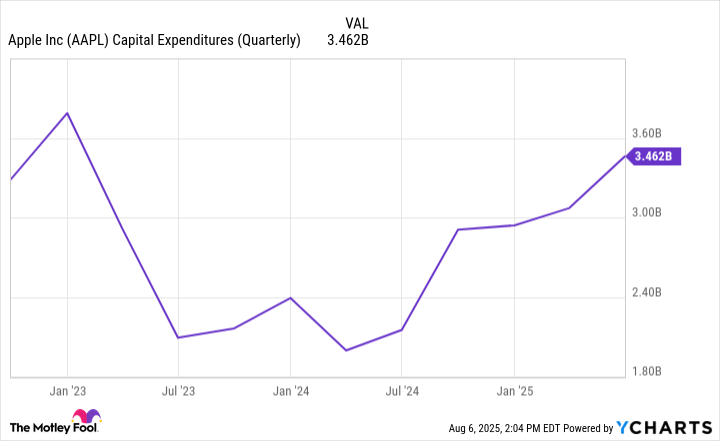

That ought to change quickly, with Apple’s administration noting on its newest earnings name that Apple is “rising [its] funding considerably in AI,” each in infrastructure and firm personnel. In its newest quarter, Apple spent practically $3.5 billion on capital expenditures, its most since its fiscal quarter that led to January 2023.

AAPL Capital Expenditures (Quarterly) knowledge by YCharts

Apple has at all times moved cautiously and with intention. These new AI funding developments do not strike me as the corporate simply now coming to its senses, however extra so Apple feeling like now could be the proper time (a lagging inventory value certain helps it come to that realization).

Picture supply: Getty Photos.

Apple’s inventory seems to be like a superb entry level for buyers

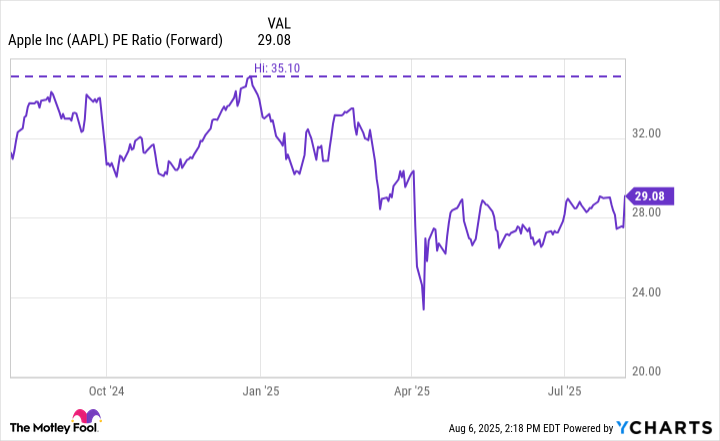

On the time of this writing, Apple is buying and selling at 29 occasions its projected earnings for the subsequent yr. That is the second-lowest out of the “Magnificent Seven” shares and under the 35 it was at to start out this yr.

AAPL PE Ratio (Ahead) knowledge by YCharts

That alone does not make Apple a purchase proper now, but it surely does give it much more upside now than earlier than. That is very true if its new AI prioritization performs out as administration envisions. With $133 billion in money and marketable securities to its title, Apple has all of the sources it wants to make sure it retains tempo within the AI race.

Stefon Walters has positions in Apple and Microsoft. The Motley Idiot has positions in and recommends Alphabet, Apple, Microsoft, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our publication, and be a part of our rising neighborhood at nextbusiness24.com