My back-to-work morning prepare WFH reads:

• Volatility Is Again within the Inventory Market. Right here’s the Zen Approach to Deal with It. The S&P 500 fell 2.7% this previous Friday, ending a 33-day streak with out a 1% transfer and highlighting renewed market volatility. Diversification past the S&P 500 is really useful, with worldwide shares up 26% 12 months to this point versus 13% for the S&P 500. (Barron’s)

• Apple’s largest iPhone overhaul in years ignites improve frenzy: Prolonged wait instances and beneficiant trade-in offers sign surging demand for newly redesigned system. (Monetary Occasions)

• How Palantir’s CEO solid a reference to traders by writing spicy shareholder letters that quote philosophers and skewer ‘technocratic elites’. Someplace alongside the way in which, Karp modified his tune. He has completed the earnings calls since Palantir went public, and about two years after that, Karp began carving out further time to pen prolonged missives within the type of shareholder letters. Alongside the corporate’s monetary outcomes, Karp fills the letters with the types of matters most executives bend over backwards to keep away from: world politics, philosophy, and even faith. You might not like what Karp has to say, however one factor is assured: It’s going to be attention-grabbing.(Fortune)

• Extra Working-Class Individuals Than Ever Are Investing within the Inventory Market: For the primary time, a majority of low earners have an funding account, and greater than half of these new traders entered the markets previously 5 years. (Wall Avenue Journal)

• Robinhood Is Banking on Infants and 401(okay)s to Get Everybody Buying and selling: After making its title on millennials and meme shares, the favored brokerage app is driving its Trump stumble upon the S&P 500 and past. (Bloomberg)

• Setting the report straight: The truths about index fund investing: Index fund investing has quite a few advantages, together with decrease prices, diversification, tax effectivity, and relative return predictability; The elevated adoption of index fund investing has heightened emphasis on the binary labels of “passive” and “energetic,” as if all index funds could be described as a monolithic, homogeneous technique. This has led to many defective assertions about index fund investing; Our evaluation dispels assertions tied to the expansion of index fund investing and presents proof that refutes key misperceptions. (Vanguard)

• Mad Libs: simply fill within the blanks. the upshot is that 12-15 Home seats might conceivably swap events earlier than the midterm elections, though the precise quantity is more likely to be lower than that. (JPM)

• Shohei Ohtani simply performed the best recreation in baseball historical past: On an evening of legendary excellence, Ohtani hit three residence runs and pitched six-plus scoreless innings to carry the Dodgers to the Nationwide League pennant. (Washington Submit)

• The Train That Takes Off 20 Years: There are a number of easy checks that may be completed at residence so as to verify our present power degree and to point out us the place we might have to enhance. (Vogue) see additionally Wait, Are Carbs Truly Superior? The carb is 180-years outdated this 12 months. Why are we nonetheless so frightened of it? (Males’s Well being)

• Diane Keaton Was Effortlessly Unique: The beloved actor was concurrently the good individual in Hollywood and in addition the individual least conscious of what anybody else thought was cool (The Ringer)

Remember to take a look at our Masters in Enterprise interview this weekend with Henry Ward, CEO and co-founder of Carta. The agency works with greater than 50,000 firms, 8,500 funding funds, and a pair of.5+ million fairness holders to handle capitalization tables, compensation, valuations, and liquidity, monitoring over $2.5 trillion in firm fairness.

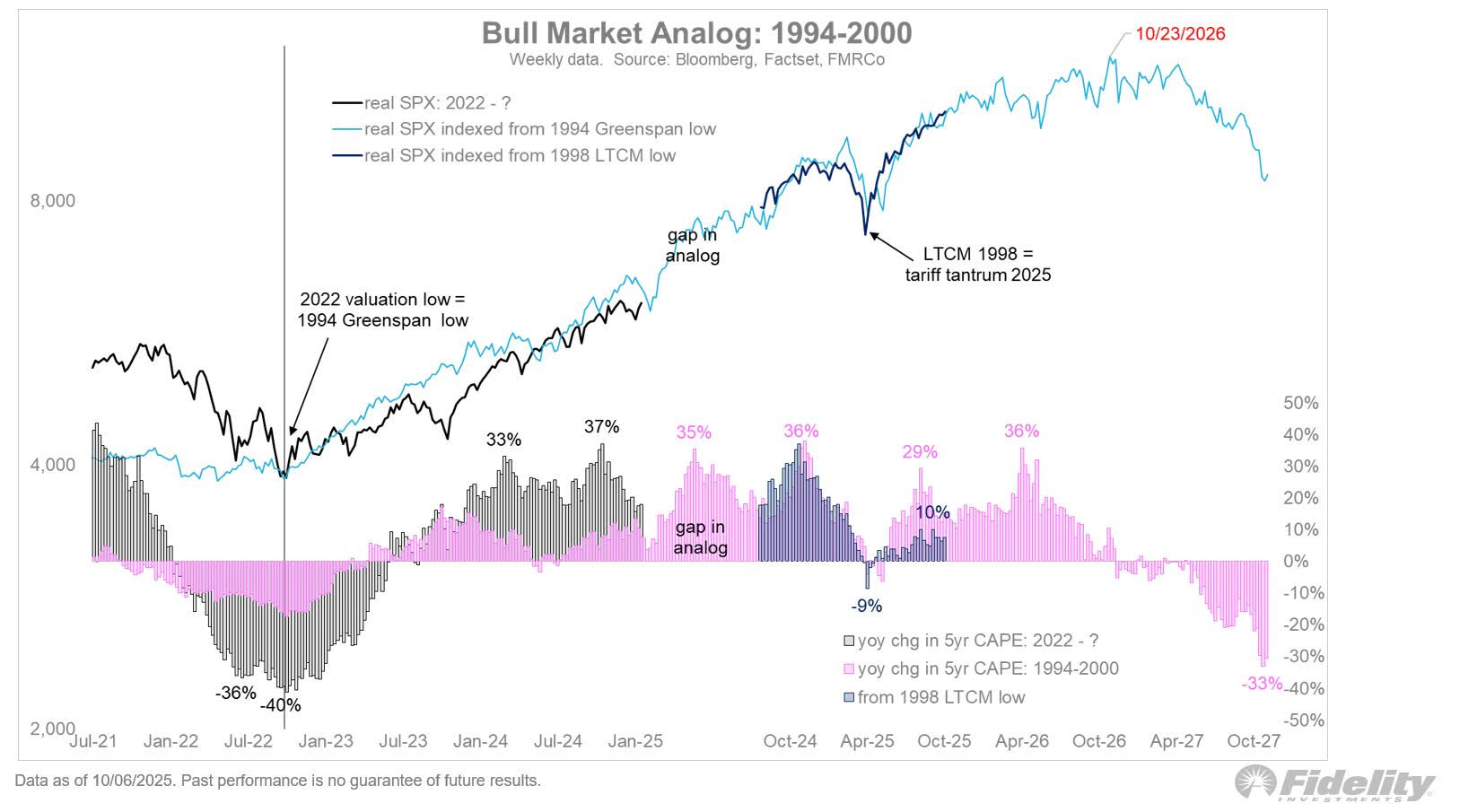

Like Greenspan in late 1998 (LTCM), Powell reduce charges even because the S&P 500 was hovering to new highs and sentiment was getting frothy

Supply: LinkedIn

Join our reads-only mailing record right here.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be part of our rising group at nextbusiness24.com