My end-of-week morning prepare WFH reads:

• Revisiting “Intelligence Drift” Why AI fashions nonetheless really feel like they’re getting dumber. Anecdotal however widespread expertise of LLMs seeming nice at first, then getting progressively “dumber” over time. With fashions like GPT-4 and Claude 3.5 Sonnet, customers reported worse solutions, incomplete responses, and outright refusals to work. (Synthetic Ignorance)

• Your Feelings Can Throw You Off Your Investing Sport. A Vanguard Professional Explains How. The top of investor analysis on the fund big outlines how early market experiences can form traders’ threat tolerance. (Barron’s) see additionally Staying Centered By means of Volatility: The Lengthy-Time period Case for this Bull Market: All these components recommend that we’re nonetheless in a multi-year development section. Is that this a possibility to create “generational wealth?” Will AI create extra millionaires in 5 years than the web did in 20? Keep centered on the strongest development shares, keep centered on the larger image, but in addition take earnings alongside the best way. (Joe Fahmy)

• What the graduate unemployment story will get mistaken: Individuals with a level are faring higher, not worse than their non-graduate counterparts. (Monetary Instances)

• Why a Conventional Funding Portfolio is Higher than Actual Property: If you wish to spend money on actual property since you need passive earnings, preserve this in thoughts: There is no such thing as a type of investing that produces earnings extra passively than a standard funding portfolio. (Move Monetary)

• The 25 Most Fascinating Concepts I’ve Present in 2025 (So Far): Charts and historical past classes—throughout tradition, politics, AI, economics, well being, science, and the lengthy story of progress. (Derek Thompson)

• It’s the Web, Silly: What brought on the worldwide populist wave? Blame the screens. (Persuasion)

• The Very Hungry Microbes That May, Simply Perhaps, Cool the Planet: They feast on bubbles of methane seeping out of the ocean flooring. May their appetites be harnessed to gradual local weather change? (New York Instances)

• All people Round Trump Hates the Unhinged Laura Loomer. Besides Trump. She has zero {qualifications}, zero expertise, zero expertise besides self-promotion. So how’d she get the nationwide safety adviser fired? (New Republic)

• They Name it ‘Magic Brew’—and It Makes MLB Stars Play Like They’re Fully Hammered: When opposing groups face the Brewers, one thing bizarre occurs: highly-paid professionals seemingly overlook tips on how to throw and catch the ball. (Wall Road Journal)

• The Astonishing Versatility of Diane Keaton: Keaton wasn’t only a gifted performer; she additionally proved to be a wonderful director. She took great images. She might sing, in a wonderful, clear voice with the allure of a robin’s warble. She adopted kids in her early 50s. She by no means married. She all the time appeared nice, expressing radical, rapturous individuality together with her clothes, her eyewear, her retro jewellery. However most importantly, she was one of the crucial glowing actors of her era, and although many individuals affiliate her largely with the brainy doodle of a efficiency she gave in Annie Corridor—an excellent one—she was astonishingly versatile. (Time)

Be sure you take a look at our Masters in Enterprise interview this weekend with Henry Ward, CEO and co-founder of Carta. The agency works with greater than 50,000 firms, 8,500 funding funds, and a couple of.5+ million fairness holders to handle capitalization tables, compensation, valuations, and liquidity, monitoring over $2.5 trillion in firm fairness.

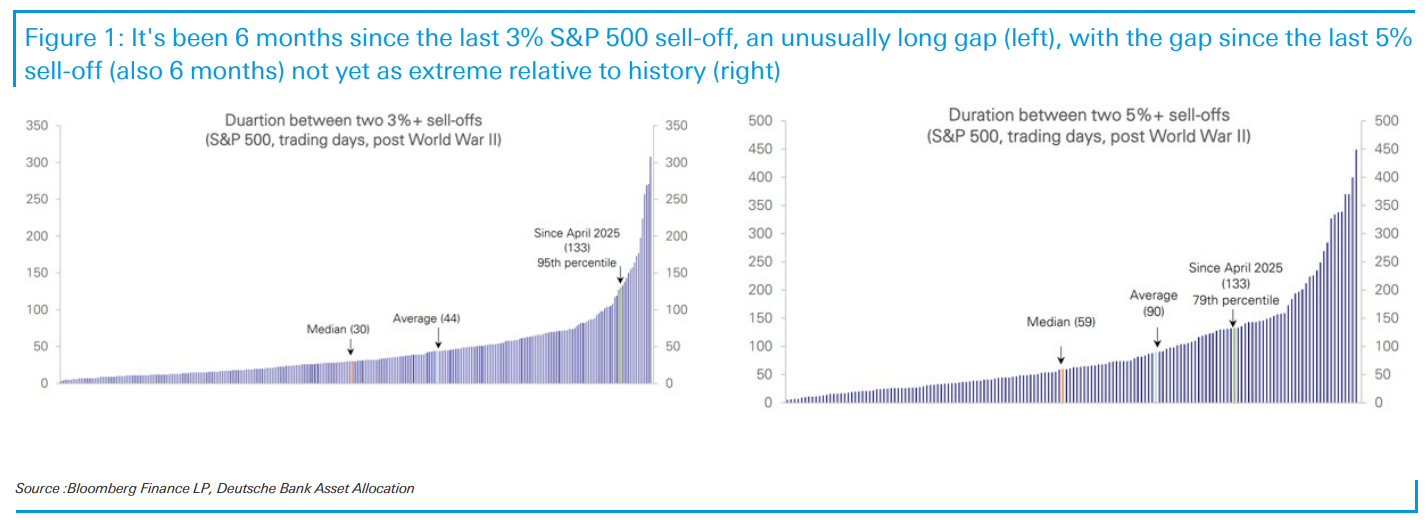

3% pullbacks happen each 1-2 months on common and 5% ones each 3-4 months. We’re at the moment at 6 months. There have been 14 longer runs since WWII with out a 3% sell-off.

Supply: Jim Reid, Deutsche Financial institution

Join our reads-only mailing checklist right here.

Keep forward of the curve with NextBusiness 24. Discover extra tales, subscribe to our e-newsletter, and be a part of our rising group at nextbusiness24.com